General Info

Initial Founders: Sean Rad

CEO: Faye Iosotaluno (44 yo)

Started in: 2012, West Hollywood, California, United States

Employees: Approx. 1,100 employees globally

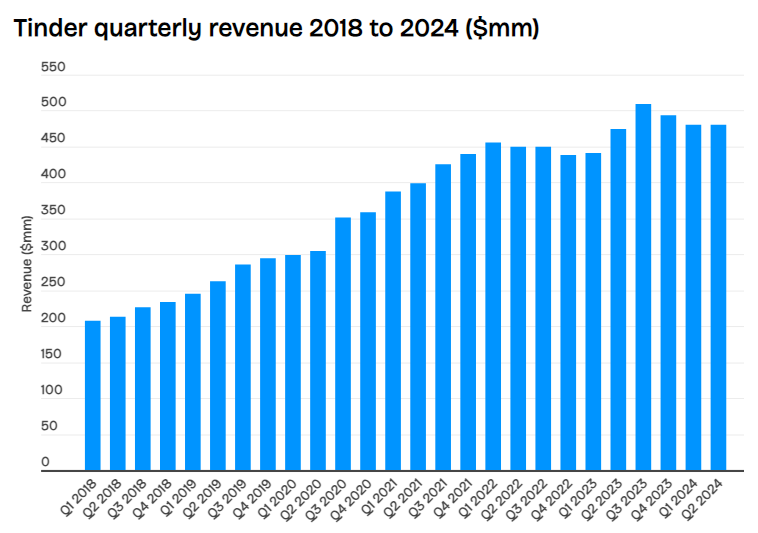

Financial Info

Revenue/Quarter: Approx $480 million (as of Q2 FY24) (up 1% from 2Q 2023)

Net Income/Quarter: Approx $2.02 billion (Q2 FY24) (down 13% from 2Q 2023)

Profit margin: 31% (as of Q2 FY24) (down from US$3.17 in 2Q 2023)

Founders and the Origin of Tinder

Tinder was born in 2012 out of Hatch Labs, an incubator within IAC (InterActiveCorp). It was founded by Sean Rad, Jonathan Badeen, Justin Mateen, Joe Munoz, Dinesh Moorjani, and Whitney Wolfe Herd, each playing a key role in its conceptualization and early development. Sean Rad and Justin Mateen, childhood friends, were particularly driven by the desire to solve a common problem: the awkwardness of online dating and the challenge of connecting with new people, especially among millennials who preferred mobile-first interactions.

How the Founders Came Up with the Idea

Sean Rad and Justin Mateen noticed a gap in the dating market. Traditional online dating platforms like Match.com or eHarmony were too formal and required significant effort from users. Rad saw an opportunity to create a more casual, mobile-centric dating platform where people could connect quickly and easily. Their initial idea was inspired by their personal experiences of rejection and discomfort when trying to meet new people in person. This insight led them to focus on creating an app where mutual interest would eliminate any awkwardness.

Their mission was clear: eliminate the fear of rejection by only allowing users to chat when both parties “liked” each other. This approach completely flipped the conventional online dating model.

Development of the “Swipe” Feature

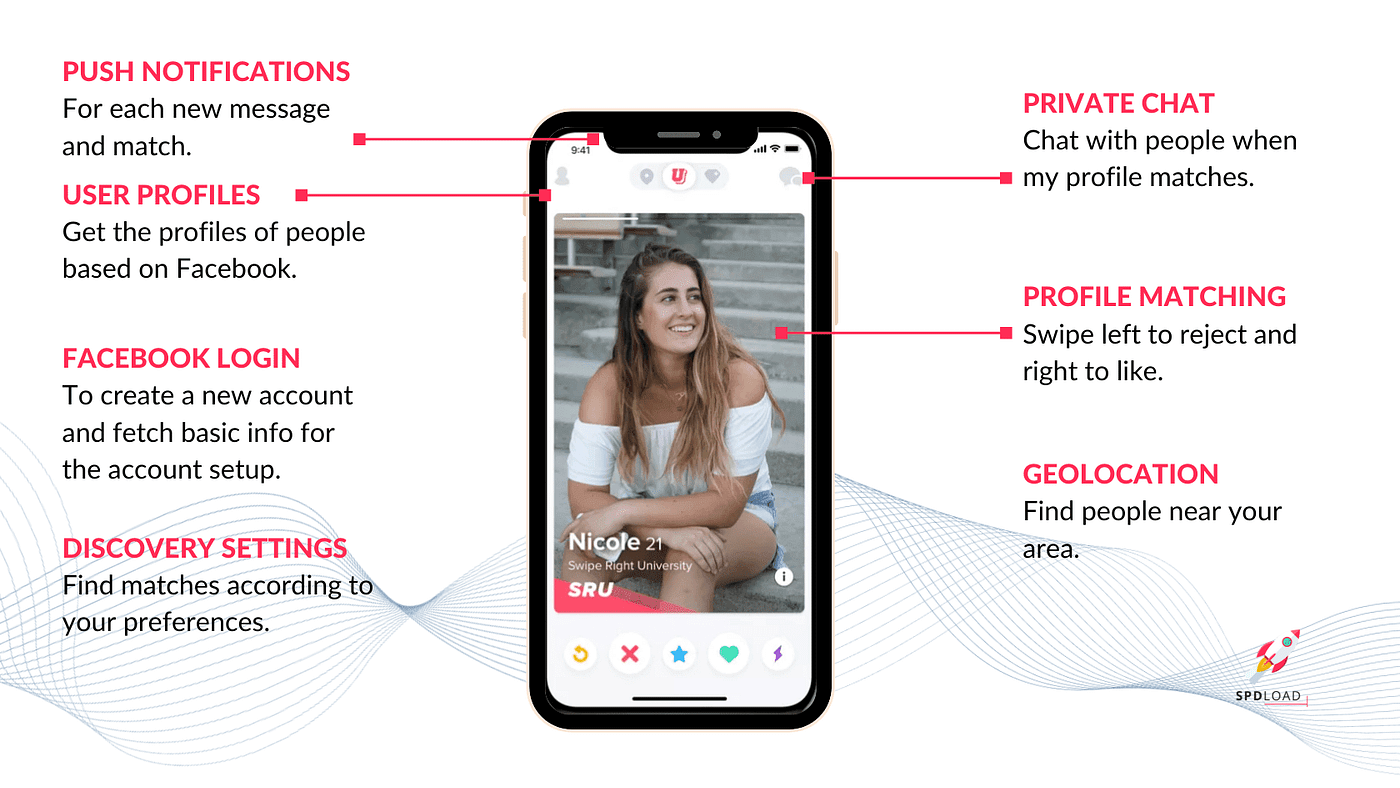

One of the most defining elements of Tinder is the “swipe” feature. The concept of swiping left to pass or right to like was originally devised by Jonathan Badeen. Badeen has mentioned that the gesture-based feature was inspired by common touch interactions on smartphones, particularly when users would swipe away items they didn’t want. This feature quickly became Tinder’s hallmark, differentiating it from all other dating apps at the time.

The simplicity and addictiveness of the swipe feature contributed enormously to the app’s early success. According to Tinder, by 2014, the app was generating 1 billion swipes per day.

Initial Market Research and Early Challenges

In the early stages, the founders focused heavily on the U.S. college demographic. They recognized that young people were more likely to adopt new social platforms and could drive viral growth. Justin Mateen, who was responsible for marketing Tinder during its launch, heavily promoted the app at colleges. To create buzz, they organized parties and events where attendees could only get in if they downloaded Tinder. This guerrilla marketing strategy led to explosive growth in user sign-ups.

However, Tinder faced significant challenges during its early days. In particular:

- Funding & Monetization: Although backed by IAC, Tinder struggled with early monetization and funding. At launch, the app was free, and there was uncertainty about how to monetize a dating app without turning away users. Monetization eventually came in 2015 with the launch of Tinder Plus and Tinder Gold, which now generate over 50% of Tinder’s revenue.

- Early App Experience: There were technical limitations and initial user experience concerns. Tinder’s user interface and algorithm underwent constant tweaking in its initial months to ensure optimal performance, especially under the high volume of swipes.

Despite these early challenges, Tinder’s focus on rapid user acquisition and its unique product offering saw the app grow exponentially. By the end of 2013, Tinder had been downloaded over 10 million times and was ranking as one of the top social apps in the App Store.

These foundational elements—the innovative swipe feature, hyper-focused initial market strategy, and solutions to early challenges—are what positioned Tinder to disrupt the dating industry from the start.

Product-Market Fit: The Swipe Revolution

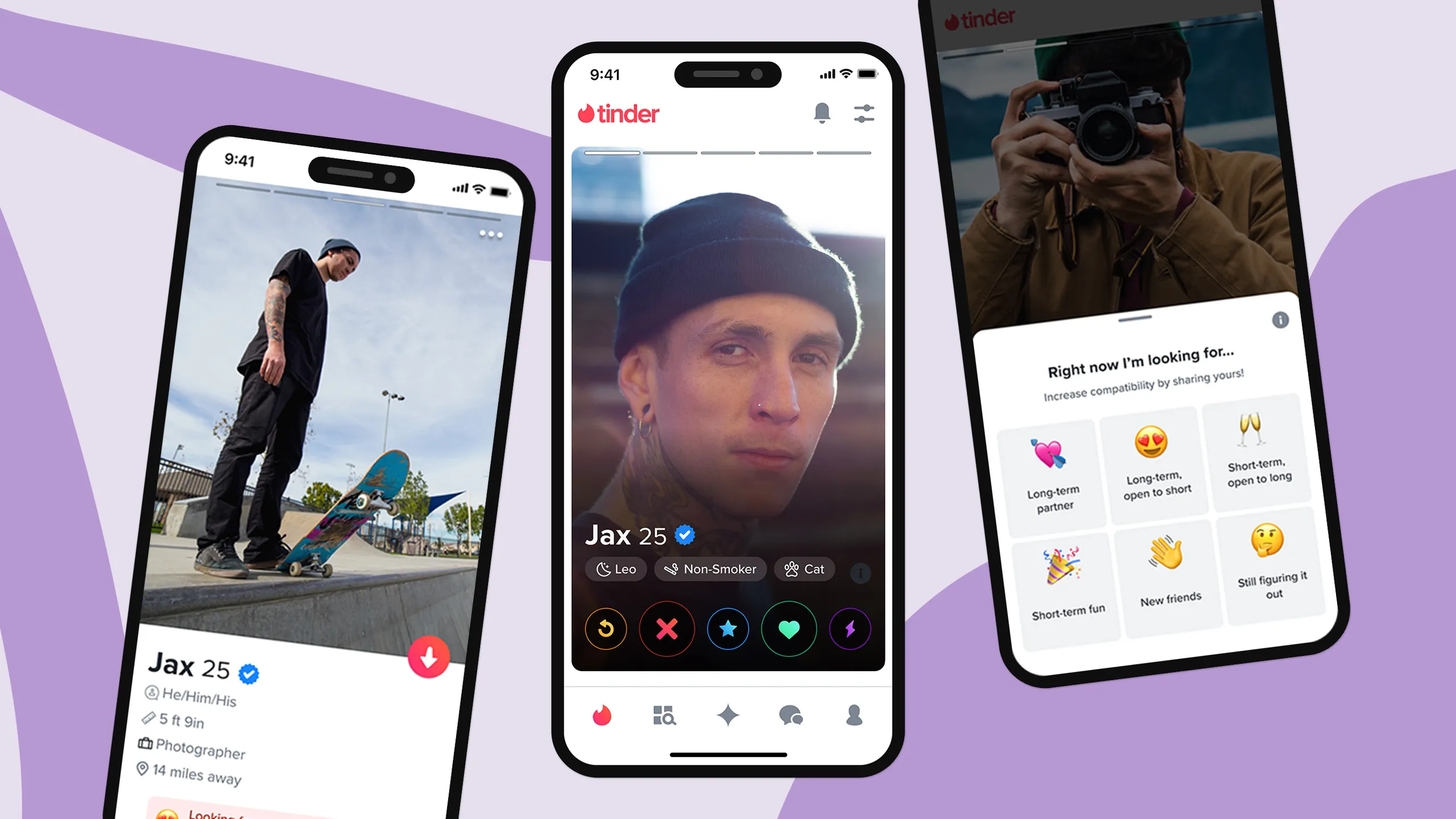

Tinder’s meteoric rise can be attributed to its ability to achieve product-market fit early on, largely driven by the revolutionary swipe feature. This simple yet game-changing mechanic turned online dating into a mobile-first, intuitive, and engaging experience, one that aligned seamlessly with the behavioral patterns of its target audience. Tinder’s success lay in understanding the psychology of its users and creating a product that not only satisfied a need but kept people coming back for more.

The Psychology Behind the Swipe Feature

The swipe feature—swipe right to like, swipe left to pass—was not just a novelty but a well-designed tool based on psychological principles. The act of swiping mimics a gamified experience, creating an instant gratification loop. Behavioral psychologists suggest that people are naturally drawn to instant feedback, and Tinder capitalized on this by turning the process of selecting potential matches into a rapid, low-effort decision. This design played into the “dopamine effect”, wherein users experienced a small burst of pleasure each time they matched with someone, reinforcing their desire to continue swiping.

By 2014, Tinder had created such an addictive user experience that it was generating 1 billion swipes per day, with users spending an average of 90 minutes daily on the app. This high engagement was directly tied to the psychology of swiping, which made the app feel more like a game than a dating service.

How Tinder Aligned Its Product with User Needs

One of Tinder’s key early achievements was aligning its product to meet the behavioral tendencies and desires of its core demographic: young, mobile-savvy users, primarily college students. Unlike traditional dating platforms that focused on lengthy profiles, questionnaires, and algorithms, Tinder simplified the process to two essential components—location and mutual attraction. By stripping down the dating process to its bare essentials, Tinder tapped into the needs of users looking for immediate, low-effort connections.

- Simplicity: The interface was designed for quick, binary decisions—yes or no. This cut down on the cognitive load typically required by dating platforms, where users often spend time crafting and reading lengthy bios.

- Mobile-First: Tinder was one of the first dating apps to fully embrace the mobile platform. Its early decision to focus on smartphones over desktop browsers allowed it to engage a younger, more tech-oriented audience. By 2013, 60% of online traffic came from mobile devices, and Tinder was ahead of the curve by being built primarily for mobile use.

Tinder’s laser focus on making the process of dating as frictionless as possible, and incorporating immediate visual attraction, perfectly aligned with the needs of its users. The product-market fit was almost instantaneous, contributing to its explosive growth.

Early User Acquisition and Feedback Loops

Tinder’s approach to user acquisition was both organic and highly targeted. Initially focusing on college campuses, Tinder’s founders leveraged peer-to-peer influence to spread the app. Justin Mateen organized campus events where the only requirement for entry was downloading Tinder. This not only created buzz but also generated an early base of young, socially active users who contributed to the app’s viral growth.

- User Growth Stats: Within 6 months of its launch, Tinder was experiencing 5 million matches a day. By the end of 2013, Tinder had over 10 million total downloads and had quickly gained a foothold in popular culture.

In addition to this organic growth, Tinder actively utilized feedback loops to improve its product. Early users were highly engaged and quick to provide feedback, which the team used to fine-tune features, fix bugs, and improve the overall experience. This responsiveness fostered a sense of community and ownership among Tinder users, reinforcing brand loyalty.

Tinder’s early ability to not only attract but retain users was due to its mastery of the feedback loop cycle:

- User Acquisition → Viral growth through targeted marketing.

- User Engagement → High daily active users (DAUs) driven by the addictive swipe feature.

- User Retention → Continuous improvements and updates based on real-time feedback.

By creating a product that seamlessly aligned with user needs and leveraging early user feedback, Tinder ensured that its app wasn’t just another fleeting social trend but a cornerstone of the dating industry.

Monetization Strategy: Tinder’s Premium Model

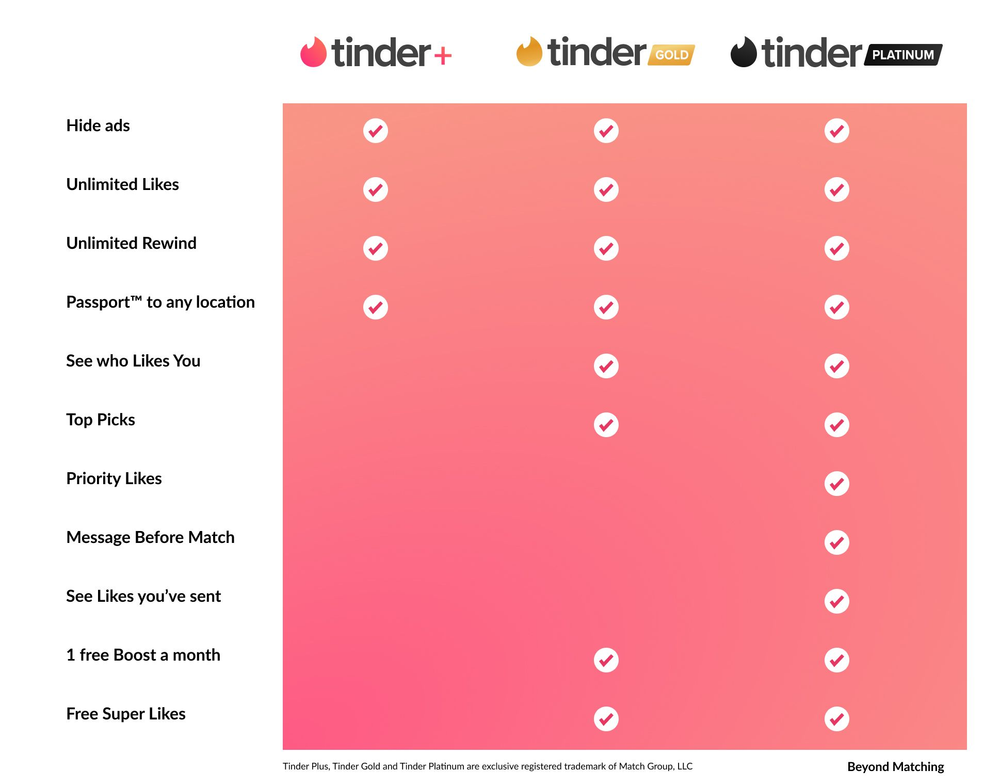

Tinder’s monetization strategy is a significant component of its sustained success, driven by a blend of premium subscription tiers and microtransactions. Initially a free app, Tinder introduced several paid features over the years to tap into its massive user base and create diversified revenue streams. Its paid model was designed in such a way that it didn’t alienate free users while offering enough value in the premium tiers to entice upgrades.

Tinder Plus, Tinder Gold, and Other Premium Tiers

The introduction of Tinder Plus in 2015 marked Tinder’s first foray into premium subscriptions. It offered users access to enhanced features that improved the dating experience, such as:

- Unlimited Swipes: While free users had a cap on the number of swipes per day, Tinder Plus allowed unlimited swiping, capitalizing on the addictive nature of the app’s core mechanic.

- Passport: A feature that enabled users to swipe in different locations worldwide, catering to frequent travelers or those who wanted to explore matches beyond their local area.

- Rewind: A valuable feature allowing users to undo their last swipe if they accidentally swiped left on someone they were interested in.

- Ad-Free Experience: Premium subscribers enjoyed the app without ads, which improved the overall user experience.

In 2017, Tinder introduced Tinder Gold, an even higher-tiered subscription, adding features like “Likes You”, which allowed users to see who had already swiped right on them before they swiped, drastically increasing the efficiency of finding matches. Tinder Gold was a major success, contributing to a surge in paid subscriptions.

- Impact of Tinder Gold: By 2019, Tinder Gold users contributed significantly to the app’s revenue, with many opting for this premium experience over the basic version. At its peak, Tinder Gold accounted for 50% of the app’s total subscription revenue, illustrating the importance of this offering.

Subscription Models and Microtransactions

Tinder’s pricing strategy for its premium tiers was also cleverly designed. Unlike many apps that employ a one-size-fits-all pricing approach, Tinder adopted dynamic pricing based on factors such as age and location. For example, younger users (under 30) were often charged lower subscription fees compared to older users, ensuring that the price was accessible to its core audience while maximizing revenue from more affluent age groups.

- Pricing Stats: Tinder Plus subscriptions typically ranged from $9.99 to $19.99 per month, while Tinder Gold ranged from $14.99 to $29.99 per month, depending on the user’s demographics and location.

In addition to subscriptions, Tinder embraced microtransactions through features like Boost and Super Likes:

- Boost: Users could pay for a Boost, which placed their profile at the top of the stack for 30 minutes, increasing visibility and potential matches. Boosts became a popular microtransaction, and Tinder priced them at around $6 per Boost, offering discounts for bulk purchases.

- Super Likes: Another microtransaction, Super Likes, let users signal extra interest in a profile by swiping up instead of right. This feature was limited to 1 free Super Like per day for free users, with additional Super Likes available for purchase at $1 each or discounted in bundles.

These microtransactions created a consistent revenue stream from both casual and committed users without relying solely on subscription income.

Conversion Rates from Free to Paid Users

One of Tinder’s key successes in its monetization strategy was its ability to convert free users into paid subscribers. By providing a basic but satisfying experience for free users and reserving attractive features for paid tiers, Tinder struck the right balance between keeping its massive free user base engaged while incentivizing users to upgrade.

- Conversion Stats: By 2020, Tinder had approximately 6 million paid subscribers, out of a global user base of over 75 million active users. This translated to a conversion rate of around 8%, which is impressive compared to other apps in the social and dating space.

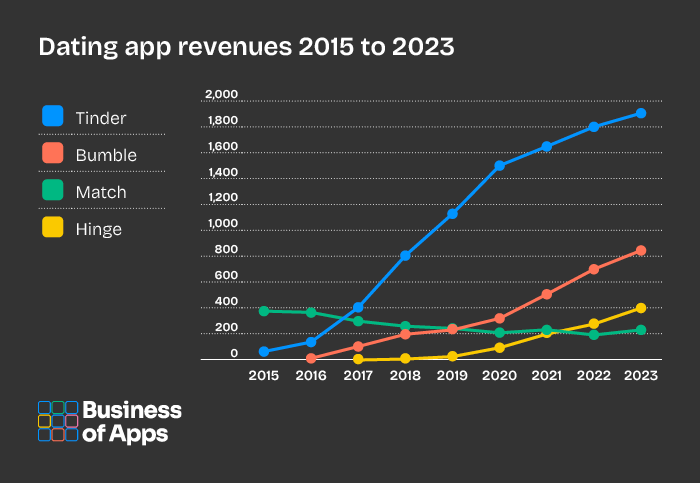

In 2021, Tinder continued to lead in the dating app market, contributing over $1.4 billion in revenue for its parent company, Match Group, and maintaining its position as the highest-grossing non-gaming app globally. A large part of this revenue came from Tinder Gold, whose features such as “Likes You” made it a compelling upgrade for many users.

User Growth and Engagement Strategies: Tinder’s Explosive Rise

Tinder’s rise to becoming one of the most popular dating apps in the world can largely be attributed to its early user acquisition tactics and the focus on virality and engagement. By leveraging strategic marketing and the psychological appeal of its swipe-based interface, Tinder successfully attracted a large, active user base from the outset and maintained growth over the years.

Viral Growth Tactics and Early User Acquisition

Tinder employed highly effective viral growth tactics, using its core feature — the swipe — as a psychological hook that made the app addictive. The “gamification” of dating through swipes encouraged users to stay engaged longer and return more frequently.

One of Tinder’s earliest and most effective viral strategies was its focus on exclusivity during its initial launch. In its early days, the app was rolled out in invite-only mode, creating a sense of scarcity that drove user curiosity. This tactic, combined with social sharing features, led to organic growth as users invited their friends, helping Tinder spread rapidly without a significant marketing budget.

Additionally, the user-friendly nature of the app — quick registration, limited profile setup, and the ease of swiping — lowered the barrier to entry, leading to higher rates of user acquisition. The frictionless interface appealed to younger, tech-savvy audiences, who became core drivers of the app’s viral success.

Use of College Campuses as a Launchpad

Tinder strategically targeted college campuses as its initial launchpad, which played a crucial role in establishing its user base. Co-founder Whitney Wolfe Herd famously visited sorority houses and fraternity parties to encourage students to download and use the app, creating buzz within these social circles. College students, being highly social and open to new technologies, were the perfect demographic to spread the app quickly and widely.

This approach proved incredibly successful, with Tinder initially gaining over 5,000 users within the first few days of its launch at the University of Southern California. As word-of-mouth spread, Tinder quickly expanded to other campuses across the U.S., leading to exponential growth. College students became some of the most active and engaged users, leading to rapid user acquisition in a highly targeted and scalable way.

Tinder’s campus-centric launch strategy was a key differentiator that helped it stand out from other dating apps at the time. The social nature of college campuses, combined with Tinder’s focus on youthful, mobile-first experiences, set the foundation for the app’s viral growth across larger geographies and demographics.

Metrics Around Daily Active Users (DAU) and Monthly Active Users (MAU)

From its early days, Tinder focused heavily on driving engagement through regular use of the app. This was reflected in its impressive Daily Active Users (DAU) and Monthly Active Users (MAU) metrics. As of 2014, Tinder reported over 1 billion swipes per day, demonstrating the sheer volume of user interaction with the app.

- By 2018, Tinder had amassed over 50 million active users, with 10 million daily active users (DAU) swiping through profiles, further solidifying its dominance in the market.

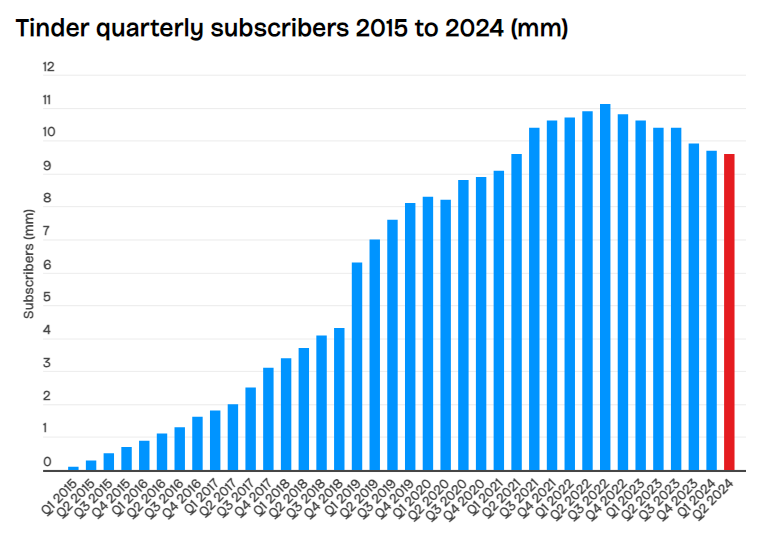

- In terms of Monthly Active Users (MAU), Tinder continued its upward trend, and by 2023, it boasted 75 million monthly active users and 10.4 million subscribers in 2023 globally. This growth was driven by both free and premium users, with free users helping to increase the overall engagement on the platform while also contributing to the app’s virality.

The swipe feature itself was a key driver of engagement, with users often swiping through hundreds of profiles in a single session. Tinder’s ability to keep users hooked and returning frequently led to long-term user retention and high engagement rates.

Additionally, Tinder effectively used push notifications and regular updates to re-engage users, encouraging them to check the app regularly and avoid “missed opportunities.” This strategy helped to increase session frequency and extend session duration, further boosting DAU and MAU metrics.

Tinder’s Growth Stats

- Tinder hit 1 million matches just 2 months after its launch in 2012.

- By 2015, Tinder was responsible for 26 million matches per day and processed over 1.5 billion swipes daily.

- In 2019, Tinder became the highest-grossing app on the App Store, generating over $1.2 billion in revenue.

- As of 2023, Tinder accounted for 57% of Match Group’s total revenue, contributing significantly to its parent company’s bottom line.

Tinder’s Use of Gamification

Tinder’s rapid success can be largely attributed to its innovative use of gamification, turning the process of dating into an engaging, swipe-based activity that felt more like a game than traditional online dating. The integration of game-like elements not only encouraged viral growth but also fostered higher levels of engagement and retention. By capitalizing on human psychology and the thrill of instant feedback, Tinder transformed dating into an addictive, interactive experience that kept users hooked.

Viral Growth Tactics and Early User Acquisition

Tinder’s viral growth is closely tied to its gamified interface. Early users were drawn to the simplicity and entertainment value of the app, which felt similar to playing a game rather than navigating a complex dating platform. The app’s swipe-based system was revolutionary in the dating world, reducing the often cumbersome process of filling out long profiles and browsing through detailed information. Users could simply swipe right if they liked someone or left if they didn’t, offering instant gratification.

This quick decision-making process appealed particularly to younger users, who were accustomed to fast-paced, mobile-first interactions. The swipe feature, combined with Tinder’s focus on instant matches, triggered dopamine rewards in the brain, making the experience addictive. Once users got their first match, they were incentivized to keep swiping in hopes of finding more, fueling organic growth through word-of-mouth.

How Gamification Elements Boosted Engagement

Tinder’s gamification extended beyond just the swipe feature. Several interactive elements were introduced to boost engagement:

- The Swipe Mechanism – At the core of Tinder’s gamified experience is the swipe. Tinder’s psychology was grounded in intermittent reinforcement, a powerful tool often used in games. The uncertainty of a swipe leading to a match kept users engaged for long periods, hoping to see if the next swipe would lead to a positive outcome.

- According to studies, Tinder users swipe through 140 profiles a day on average, with the most active users swiping even more. This continuous action mimics the mechanics of many popular mobile games, where users engage in repetitive actions for rewards.

- The Matching System – Tinder’s instant matching system provided immediate feedback, akin to a win in a game. When two users swiped right on each other, they were instantly notified of a match, which gave a sense of accomplishment and pushed users to continue swiping to get more “wins.”

- This mechanism led to over 26 million matches per day in 2015, with Tinder processing 1.5 billion swipes daily, reflecting how the app was able to keep users highly engaged through game-like elements.

- Super Likes and Boosts – Tinder introduced Super Likes in 2015, allowing users to express heightened interest in someone. This feature added another layer of engagement, as it provided a more direct form of communication compared to regular swipes.

- According to Tinder, users who use Super Likes are 3 times more likely to receive a match. This gamified feature created a sense of urgency and exclusivity, making users feel special when they received a Super Like.

- Boosts and Top Picks – Tinder also implemented paid gamified features such as Boosts, which would make a user’s profile more visible for a set period, and Top Picks, which highlighted selected users based on their preferences. These features encouraged users to stay active on the app, as the algorithm would reward frequent engagement with better match visibility.

- In 2019, Tinder revealed that more than 50% of their revenue came from paid features such as Boosts and Super Likes, showing the financial impact of these gamification strategies.

Retention Strategies Through Gamification Features

Tinder’s gamification strategies didn’t just focus on acquiring users—they also aimed to retain them through engaging, interactive features that kept users returning to the app regularly.

- Daily Swipe Limit for Free Users – One of Tinder’s key retention strategies was its decision to introduce a daily swipe limit for free users, encouraging them to return the next day to continue swiping. This tactic mirrored the mechanics of many mobile games, where users are given a limited number of actions they can perform per day, creating a natural retention loop.

- This strategy helped Tinder maintain a steady flow of daily active users (DAU), with 10 million DAU reported in 2018.

- Tinder Streaks and Habit-Forming Mechanisms – By introducing features such as swiping streaks, Tinder encouraged habitual use. Users would be rewarded with higher visibility or better matches if they used the app consistently, further gamifying the experience.

- These habit-forming mechanisms helped boost user retention, with Tinder boasting 75 million monthly active users (MAU) by 2020.

- Leaderboards and Competitive Features – Tinder toyed with the idea of adding competitive elements, such as leaderboards showing users their match performance compared to others. While this feature wasn’t as prominent, it reflected Tinder’s desire to push users toward competitive interactions, encouraging them to engage more deeply with the app.

Impact of Gamification on Tinder’s Success

Tinder’s effective use of gamification played a significant role in its growth, boosting both engagement and retention while fostering user loyalty. By offering users an interactive, dopamine-driven experience, Tinder differentiated itself from more traditional dating platforms and created a viral, addictive product that appealed to the mobile-first generation.

- In 2020, Tinder had become the top-grossing non-gaming app globally, generating over $1.4 billion in revenue, largely through its gamified premium features.

- Tinder reported 1.6 billion swipes per day in 2021, showing how deeply gamification had become embedded in the app’s success.

Competitive Landscape: Standing Out in a Crowded Market

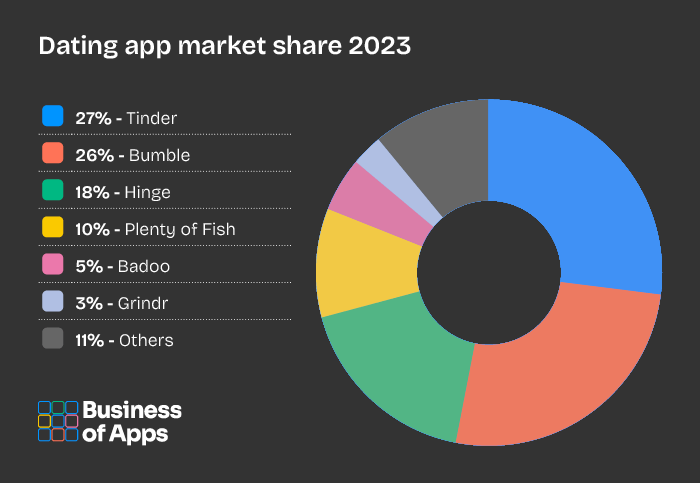

As Tinder rapidly gained traction in the online dating industry, it entered a space already populated by well-established competitors like Match.com, OkCupid, and later Bumble and Hinge. Despite this crowded landscape, Tinder not only carved out a dominant position but also redefined how people interacted with dating apps. Its success was driven by key differentiators and strategic adaptations to market saturation, ensuring its growth even as competition intensified.

Analysis of Competitors: Bumble, Hinge, and Match

- Bumble – Launched in 2014 by Whitney Wolfe Herd, a former Tinder executive, Bumble positioned itself as a female-centric alternative to Tinder. Bumble differentiated itself by allowing women to make the first move, a feature that appealed to users looking for more controlled and respectful interactions. Bumble quickly gained popularity, reaching over 100 million users by 2020. Despite this, Tinder maintained its lead by leveraging its massive user base and engagement metrics, with 6.44 million subscribers in the same year, compared to Bumble’s 2.2 million.

- Hinge – Hinge branded itself as the app designed to be deleted, focusing on long-term relationships rather than casual hookups. By removing the swipe feature and encouraging users to engage more meaningfully, Hinge catered to a different demographic than Tinder. However, Hinge still trailed behind Tinder in terms of user acquisition, with 10,400,000 subscribers in 2023, compared to Tinder’s 75 million monthly active users (MAU) globally.

- Match.com and OkCupid – As more traditional online dating platforms, Match.com and OkCupid struggled to adapt to the mobile-first, gamified experience that Tinder offered. Match Group, recognizing Tinder’s potential, acquired it early on and positioned it as its flagship dating app. In 2023, Tinder generated nearly 57% of Match Group’s total revenue of $1.9 billion, overshadowing Match.com and OkCupid.

Key Differentiators That Made Tinder Successful

- Swipe Mechanism – Tinder’s iconic swipe feature was a game-changer in the dating industry. Unlike traditional dating apps that focused on long profiles and in-depth questionnaires, Tinder offered instant gratification with a simple swipe left or right. This approach appealed to younger, mobile-savvy users, particularly Millennials and Gen Z, who preferred quick, intuitive interactions over lengthy dating processes.

- By 2020, Tinder was processing an astounding 1.6 billion swipes per day, far exceeding its competitors.

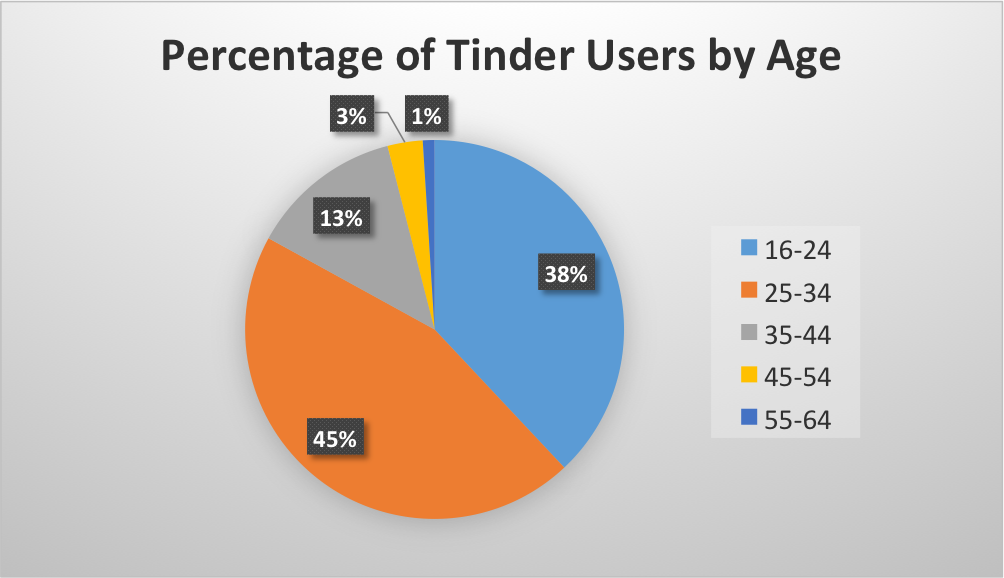

- Focus on Casual Dating – While apps like Bumble and Hinge targeted users seeking relationships, Tinder’s success lay in catering to users looking for casual dating and instant connections. This approach resonated with a broader audience, particularly among the 18-24 demographic, where 76% of Tinder users fall, helping Tinder establish itself as the go-to app for this group.

- Mobile-First Design – Tinder was designed specifically for mobile users, a major shift from traditional dating platforms that focused on desktop experiences. By prioritizing the mobile experience and creating an app that could be used anywhere, anytime, Tinder created an unprecedented level of convenience and accessibility for its users.

- As of 2020, Tinder accounted for 57% of global dating app downloads, further solidifying its dominance in the mobile space.

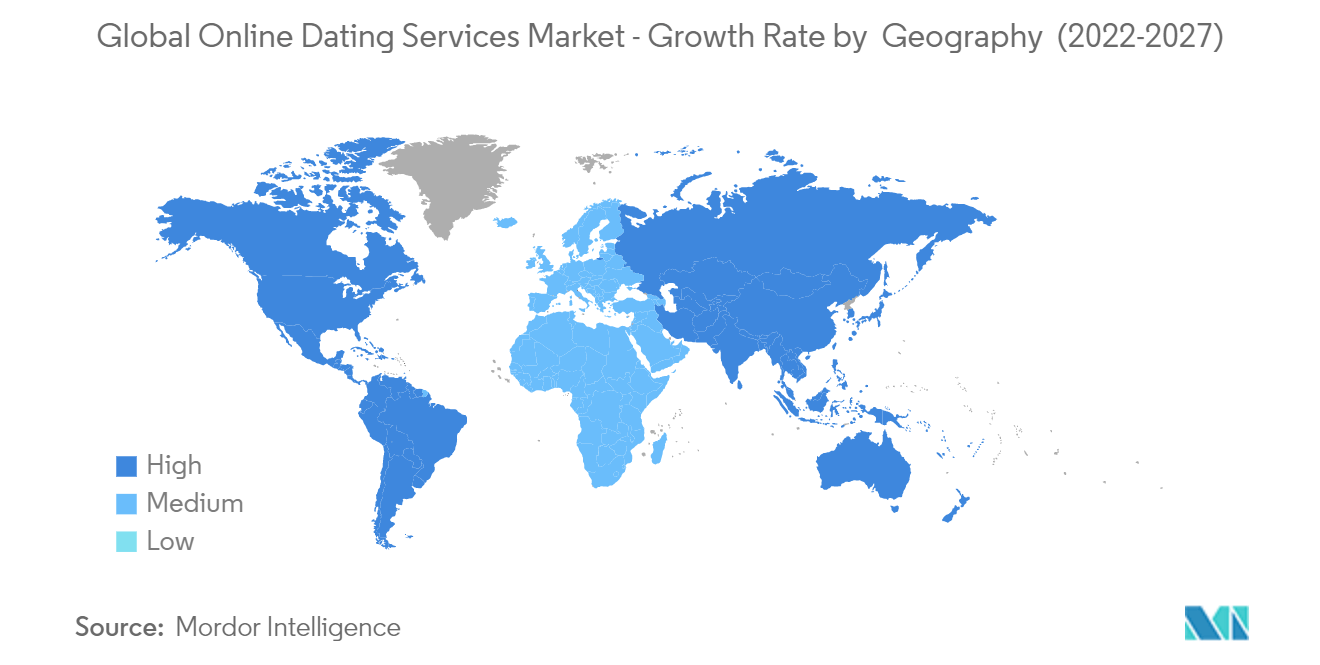

- Global Reach and Inclusivity – Tinder’s international expansion allowed it to become a global phenomenon. By 2020, Tinder was available in 190 countries and supported over 40 languages, making it one of the most inclusive dating platforms in the world. This wide-reaching approach gave Tinder an edge over regional competitors and allowed it to tap into diverse markets worldwide.

How Tinder Adapted to Market Saturation

- Constant Feature Innovation – To stay ahead of competitors, Tinder continually introduced new features like Super Likes, Boosts, and Tinder Passport. These paid features enhanced the user experience while offering additional ways for users to connect, keeping Tinder relevant as market saturation grew. The introduction of premium tiers, such as Tinder Plus and Tinder Gold, allowed Tinder to monetize its large user base effectively.

- Tinder Gold became particularly successful, with 81% of the app’s revenue in 2020 coming from subscription services. By offering users more visibility and exclusive features, Tinder managed to convert a significant portion of its free users into paying subscribers.

- Partnerships and Campaigns – Tinder adapted to market saturation by launching creative campaigns that resonated with its user base. For example, Tinder collaborated with Spotify to allow users to display their top songs on their profiles, adding a personal touch and attracting music lovers. These kinds of partnerships helped Tinder stay relevant in a competitive market.

- Data-Driven Insights – Tinder leveraged user data to continually refine its algorithms, ensuring that it delivered matches that aligned with user preferences. The app’s focus on data allowed it to optimize the user experience, improving match quality and boosting engagement. This attention to data helped Tinder maintain high daily and monthly active user counts, ensuring users remained on the platform despite increasing competition.

- By 2020, Tinder boasted over 6.2 million paying subscribers, contributing to its $1.4 billion in revenue that year, a figure that outpaced all other dating apps in the industry.

- Localized Marketing – Tinder understood the importance of adapting its marketing strategies to different regions. For instance, it targeted college students in the U.S. with ambassador programs while focusing on influencer marketing in markets like India. This localized approach allowed Tinder to grow its user base in emerging markets, helping the app expand beyond its core demographic and increase its global presence.

- Brand Identity and Pop Culture Integration – Tinder leaned into pop culture and integrated its brand into various aspects of modern dating culture. The app’s frequent mentions in television shows, movies, and social media conversations helped it become synonymous with modern dating, contributing to its cultural ubiquity and ensuring its relevance among younger users.

Statistics That Prove Tinder’s Dominance

- Market Share: Tinder dominated the online dating industry with a global market share of 42% as of 2020, well ahead of its closest competitors.

- Revenue: Tinder generated over $1.4 billion in revenue in 2020, making it the highest-grossing non-gaming app in the world.

- Subscriber Growth: Tinder had 10.4 million paying subscribers by the end of 2023 compared to 6.2 million paying subscribers by the end of 2020, with Tinder Gold and Tinder Plus being the primary drivers of revenue growth.

- Global Downloads: Tinder accounted for 30% of all dating app downloads in 2020, solidifying its position as the most downloaded dating app worldwide.

Global Expansion and Localization

Tinder’s success is not just limited to its core markets; it has effectively expanded its presence globally by adopting unique localization strategies and customizing its platform to align with regional dating norms. This ability to adapt while retaining its core identity has allowed Tinder to capture diverse markets across the globe, ensuring continued growth and dominance in the online dating industry.

Strategies for Entering New Markets

- Localized Marketing Campaigns – Tinder’s global expansion was driven by its focus on tailoring marketing strategies to resonate with the cultural and social norms of each region. Instead of applying a one-size-fits-all approach, Tinder rolled out hyper-localized campaigns that appealed to the specific interests, values, and trends of users in different countries. For instance, in countries like India, Tinder partnered with local influencers to promote the app’s appeal to younger, urban users.

- Statistics: Tinder reported a 400% increase in downloads in India between 2015 and 2019, making it one of the fastest-growing markets for the company. By 2020, Tinder had more than 7 million users in India alone.

- Tinder Passport – To facilitate international growth and allow users to connect across borders, Tinder introduced the Passport feature, which enabled users to swipe in any city or country of their choice. This feature became particularly popular in countries with high travel rates and among users looking to connect internationally, enhancing Tinder’s appeal as a global dating app.

- Statistics: In 2020, the usage of Tinder Passport surged by 25% during the pandemic, as people used the feature to connect with others globally while in lockdown.

- College Campus Strategy Adaptation – Building on its U.S.-based college campus ambassador program, Tinder adapted this strategy for its global expansion by recruiting local campus representatives in regions such as Europe, Latin America, and Asia. This grassroots-level marketing campaign allowed Tinder to penetrate youth markets in new countries, particularly in Brazil and India, where dating apps were still gaining traction.

- Statistics: Brazil emerged as one of Tinder’s largest markets, with Tinder being one of the top 5 most downloaded apps in the country.

- Freemium Model – In countries with a lower average income per capita, Tinder leveraged its freemium business model more effectively by offering free access to its core features while introducing local, affordable premium subscription tiers. This pricing flexibility allowed Tinder to attract users from varying economic backgrounds while still driving revenue growth.

- Statistics: Tinder maintained 3.6 million paid users in North America in 2020, with another 2.5 million across international markets, proving the global impact of its subscription strategy.

Localization Efforts and Dealing with Regional Dating Norms

- Adapting to Cultural Sensitivities – As Tinder expanded into more conservative markets, it became essential to adapt the app to align with regional dating norms. In countries like India, where traditional matchmaking is more prevalent than casual dating, Tinder modified its marketing efforts to focus on making meaningful connections. Tinder also rolled out features like Tinder Lite, a lightweight version of the app designed for countries with lower bandwidth and limited data usage, particularly in Southeast Asia.

- Statistics: Tinder Lite reduced data consumption by 20% compared to the main app, making it accessible in regions where high-speed internet is not widely available.

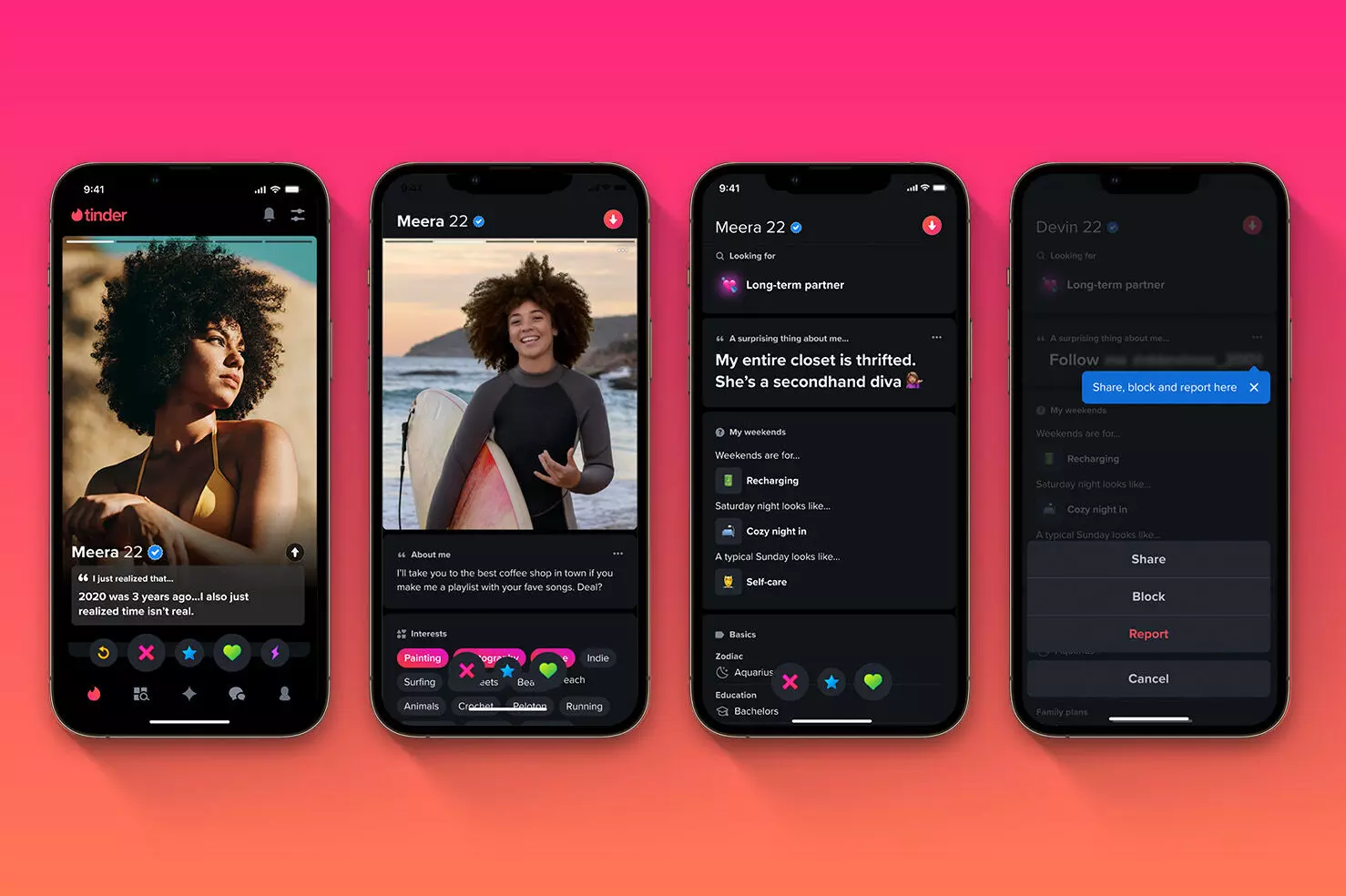

- Gender Inclusivity and Safety Features – Tinder made a conscious effort to be inclusive by offering gender identity options beyond just “male” and “female,” recognizing the diverse needs of users globally. In more conservative countries, Tinder worked to strike a balance between inclusivity and local norms. Safety features like photo verification and safety center updates were also introduced to increase trust in the app, which was crucial for its success in regions where online dating was less common or stigmatized.

- Statistics: Tinder launched 23 new gender options globally in 2016, helping attract a wider user base, particularly in markets like the U.S., Europe, and Australia.

- Localized Features – Tinder also localized its features to cater to regional tastes. For example, in Japan, Tinder introduced a feature that allowed users to send “Super Likes” with personalized messages, aligning with Japanese cultural norms of politeness and communication. In South Korea, where dating apps were initially viewed with skepticism, Tinder introduced more profile customization options to appeal to users’ desire for expressing individuality.

- Statistics: Japan became Tinder’s second-largest Asian market by 2020, with over 3 million downloads and growing.

- Navigating Regulatory Challenges – In some markets, Tinder had to navigate regulatory hurdles around online dating and data privacy. For instance, in Russia, Tinder was required to comply with local data storage regulations. Tinder also had to be mindful of content restrictions in markets like China and Saudi Arabia, where dating apps faced heavier government scrutiny.

- Statistics: Despite the challenges, Tinder’s careful navigation of regulatory issues allowed it to remain accessible in more than 190 countries by 2020.

- Cultural Norms and Gender Dynamics – Tinder recognized that dating norms differ significantly across regions, particularly in terms of gender dynamics. In markets like India and the Middle East, where traditional dating roles persist, Tinder worked to encourage more respectful and secure interactions through features like photo verification and “women first” messaging in countries with strong gender norms. This localization helped Tinder overcome some of the cultural challenges that other global platforms struggled with.

- Statistics: In India, Tinder witnessed a 100% increase in female users between 2016 and 2020, a key indicator of its success in tackling regional gender dynamics.

Marketing Strategies and Brand Evolution

Tinder’s marketing and branding have played a crucial role in its massive success, with strategies that have evolved in response to both market demand and shifting user expectations. From its early days as a “hook-up” app to a more comprehensive platform for relationships, Tinder has employed a multi-faceted approach to marketing that catered to a variety of users, keeping it relevant and continuously growing.

1. Tinder’s Approach to Marketing and Branding

Tinder’s initial branding focused on casual dating and fun, targeting younger users, especially college students. The playful and casual nature of the app was reflected in its marketing campaigns, including memorable taglines such as “Swipe right for love.”

- Targeting College Students: Tinder’s early marketing strategy, in particular, was brilliant in using college campuses as a launchpad. In 2012, they went directly to fraternities and sororities to create organic buzz. Within a year, Tinder’s user base exploded from a small local group to millions globally.

- Brand Messaging: The emphasis was on simplicity, fun, and the thrill of meeting new people. This resonated with a younger, tech-savvy audience. Tinder’s playful language and design helped position it as an app for casual, low-stakes interactions.

2. Influencer Partnerships and Social Media Strategies

Tinder’s presence on social media was key to its virality. The company successfully leveraged social media platforms such as Instagram, Twitter, and Facebook to reach a massive audience.

- Influencer Partnerships: Tinder collaborated with celebrities and influencers to enhance its cool, trendy image. Notable partnerships with stars such as Hilary Duff, who used the app to go on dates publicly, brought visibility and trust to Tinder’s brand. These partnerships helped break any social stigmas about using dating apps, making Tinder seem more mainstream.

- Hashtag Campaigns: Hashtags like #SwipeRight became part of popular culture, further enhancing the brand’s visibility. The 2015 “Swipe Off” competition, where users could compete for a chance to win dates, generated significant buzz and user interaction.

- Memorable Campaigns: One of Tinder’s most viral marketing campaigns was “In Swipe We Trust,” which featured real Tinder success stories and user-generated content, enhancing relatability.

- Tinder Social: In 2016, Tinder launched “Tinder Social” to allow groups of friends to meet others in a group setting, tapping into more than just romantic relationships.

3. Ad Campaigns and Data-Driven Targeting

Tinder used strategic ads and data-driven marketing to continually refine its outreach.

- Programmatic Advertising: Tinder heavily invested in programmatic advertising, using behavioral data to show ads in apps and platforms where potential users were most active. The company’s programmatic ad strategy targeted users based on their location and dating preferences.

- Brand Awareness: Tinder’s “It Starts Here” campaign aimed at redefining Tinder as more than a hook-up app by showing users in more diverse, serious relationships.

4. Evolution from Hook-Up App to Broader Relationship Platform

One of Tinder’s biggest evolutions has been its gradual shift from being perceived primarily as a hook-up app to becoming a more general relationship platform. This rebranding effort involved substantial changes in Tinder’s messaging and the types of features it promoted.

- Inclusive Messaging: Tinder increasingly began to focus on inclusion, emphasizing that the app is for everyone — whether users are looking for casual dating, friendships, or long-term relationships. In a 2020 campaign, Tinder highlighted stories from all kinds of relationships formed on the app, from LGBTQ+ partnerships to long-term couples.

- User Data & Feedback: By analyzing user behavior and feedback, Tinder realized that many users sought more than casual relationships. They adjusted their brand messaging and product features to cater to these users, thus broadening their user base and improving retention.

- Focus on Global Love Stories: As part of the rebranding strategy, Tinder shared more global love stories. This narrative helped to shift public perception, moving beyond the narrow hook-up focus. As of 2022, Tinder is available in over 190 countries with 75 million monthly active users, and over 55 billion matches have been made, indicating that users are not solely interested in casual encounters .

Adapting to Consumer Privacy and Safety Trends

In the digital age, consumer privacy and safety have become paramount, and Tinder has made significant strides to address these concerns. As a leading dating app, Tinder recognized early on the need to safeguard user data and create a safer environment for its users, responding to growing concerns about privacy and harassment.

1. User Privacy and Data Protection

As Tinder grew to millions of users globally, data privacy became a critical focus. The app collects sensitive personal data, including location, gender preferences, and interactions, making it vital to maintain high standards of data protection.

- GDPR Compliance: In 2018, Tinder adapted to the European Union’s General Data Protection Regulation (GDPR), which required companies to give users more control over their data. As a result, Tinder enhanced transparency by allowing users to download their data and understand how it was being used. This was crucial, as a report by Pew Research found that 47% of Americans were concerned about how their personal data was being used by online services, with dating apps among the most scrutinized.

- Data Encryption: Tinder implemented robust data encryption techniques to protect user data from breaches. All communications between users and the platform were encrypted, ensuring that sensitive information like location, messages, and preferences were secure.

- Third-Party Audits: To improve trust, Tinder began conducting third-party audits to assess its data security practices, making sure it met industry standards and protected users’ information.

2. Initiatives to Reduce Harassment and Create a Safer Environment

Online dating platforms are often criticized for being breeding grounds for harassment, stalking, and unsolicited behavior. In response to these challenges, Tinder invested heavily in creating a safer user experience by introducing several new features and partnering with safety organizations.

- Photo Verification: In 2020, Tinder introduced a photo verification feature that allowed users to verify their profiles by taking real-time selfies that matched their profile photos. This step aimed to reduce the number of fake profiles and “catfishing” incidents, an issue that affects about 10% of online dating users. Verified profiles were marked with a blue check, giving users an extra level of assurance about who they were interacting with.

- Safety Center: Tinder launched a Safety Center within the app that provided users with access to information on how to date safely, report inappropriate behavior, and contact support if they felt threatened. This was in partnership with organizations like the Rape, Abuse & Incest National Network (RAINN), focusing on offering users educational tools on safety.

- Report and Block Features: Tinder streamlined its in-app reporting system, allowing users to quickly report any abusive, harassing, or inappropriate behavior. The company promised immediate responses to severe cases, resulting in the banning of over 3 million users in 2021 for violating community guidelines.

- “Does This Bother You?” and “Are You Sure?” Features: These were introduced as AI-driven features that detect potentially harmful messages. If a message contains offensive or harmful language, Tinder prompts the recipient with “Does This Bother You?” and asks the sender, “Are You Sure?” before sending it. According to Tinder, more than 50% of users changed their message after receiving the “Are You Sure?” warning, showing an effective reduction in toxic behavior.

- Partnership with Noonlight: In 2020, Tinder partnered with Noonlight, an app that allows users to discreetly call emergency services if they feel unsafe on a date. Users can share details of their date and real-time location with Noonlight, which then tracks their movements. If necessary, authorities can be alerted. This collaboration was a direct response to safety concerns raised by users and was part of Tinder’s broader strategy to enhance user protection.

3. Video Chatting for Safer First Encounters

Recognizing the risks associated with meeting strangers in person, Tinder rolled out a video chat feature in 2020, allowing users to connect virtually before meeting. This not only catered to safety concerns but also met user demand during the COVID-19 pandemic when in-person meetings were restricted.

- Face to Face Feature: The feature required mutual consent, ensuring both parties agreed before a video chat could occur. Tinder reported that this led to more than 40% of users using video chat during the pandemic, offering an added layer of security for first interactions.

4. Commitment to LGBTQ+ Safety

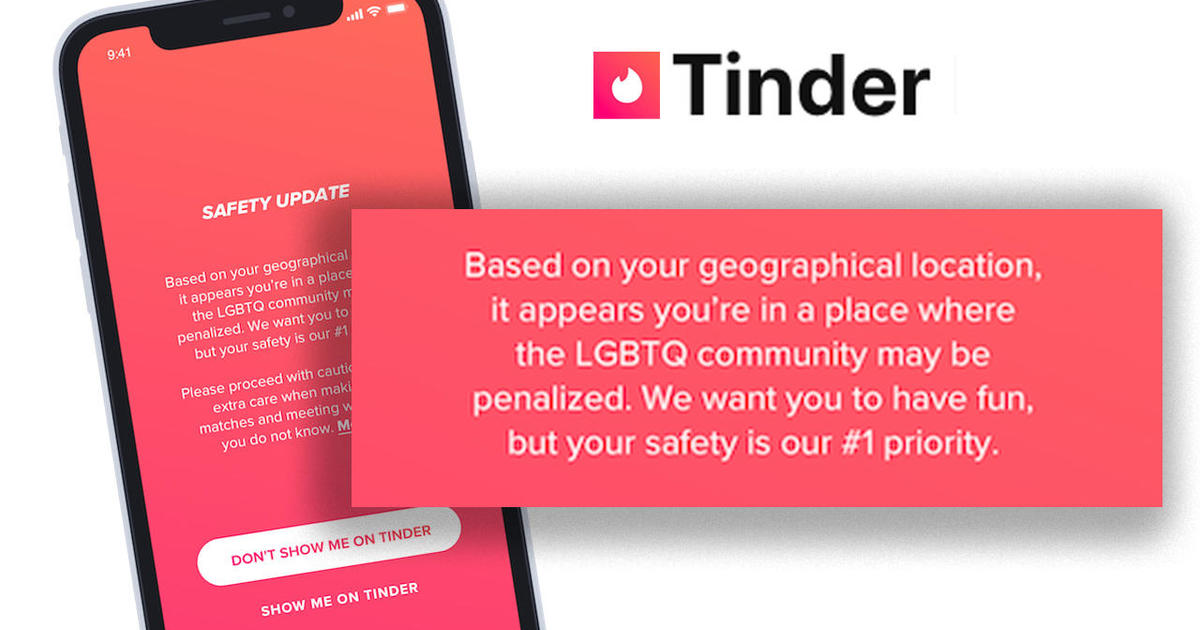

Tinder has taken steps to make the platform safer for its LGBTQ+ users. In many countries, identifying as LGBTQ+ can be dangerous, so Tinder introduced a feature that automatically hides users’ profiles in areas where same-sex relationships are criminalized.

- Traveler Alert: Launched in 2019, this feature alerts users if they are in a country with discriminatory laws and allows them to hide their profile while they’re in that region. Tinder partnered with ILGA World (International Lesbian, Gay, Bisexual, Trans and Intersex Association) to provide real-time data on regions where users might face danger based on their sexual orientation.

Statistics Supporting Tinder’s Safety Initiatives:

- 54% of users said they felt safer using Tinder after the introduction of the photo verification feature (2021 internal report).

- Over 1 million fake accounts were detected and removed within the first year of launching photo verification.

- The addition of AI-driven harassment detection led to a 10% decrease in reported incidents within the first six months of its introduction.

Key Takeaways for Entrepreneurs

- Innovate in Competitive Markets:

- Tinder entered a crowded dating market but stood out with its unique swipe feature, which led to 1.6 billion daily swipes.

- Lesson: Focus on a simple, innovative feature that differentiates your product.

- Use Data to Drive Decisions:

- Tinder uses AI and data analytics to personalize matches, improving engagement. Users engaging with personalized matches saw a 25% higher match rate.

- Lesson: Leverage data to enhance user experience and refine your product.

- Freemium Model with Clear Value:

- Tinder’s premium tiers like Tinder Plus and Tinder Gold led to 10.4 million paying subscribers in 2021.

- Lesson: Offer valuable premium features to convert free users into paying customers.

- Target Early Adopters for Growth:

- Tinder launched on college campuses, driving 500,000 downloads within its first year through viral, word-of-mouth marketing.

- Lesson: Focus on specific user groups to build initial traction.

- Continuously Improve Based on Feedback:

- Tinder introduced features like Super Likes and Swipe Surge based on user feedback, increasing engagement.

- Lesson: Constantly iterate your product to meet evolving user needs.

- Build a Strong, Adaptable Brand:

- Tinder transitioned from a hook-up app to a platform for various relationships, with its “Single, Not Sorry” campaign.

- Lesson: Be flexible with branding to align with consumer perceptions.

Leave a Reply