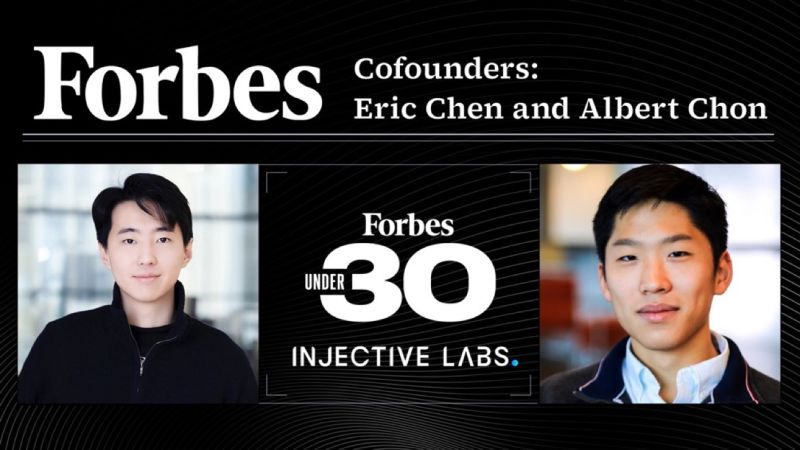

In the rapidly evolving world of decentralized finance, where most blockchain projects struggle to achieve meaningful adoption, Eric Chen‘s Injective Protocol has emerged as a transformative force. This comprehensive profile examines how a visionary computer scientist built one of the most technically sophisticated and institutionally-adopted blockchain platforms in existence today.

With $50+ billion in cumulative trading volume, 1.4 million+ active addresses, and partnerships spanning from Rakkar Digital to BlackRock, Injective represents the vanguard of institutional-grade DeFi infrastructure. This deep dive explores:

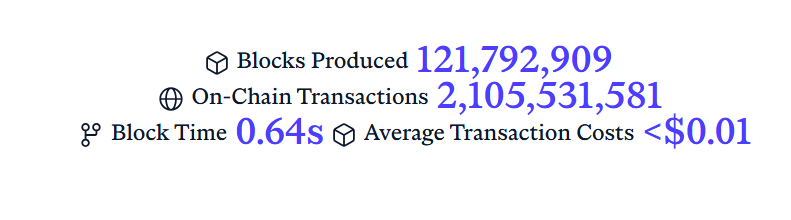

- The technical breakthroughs enabling 25,000 TPS throughput with sub-second finality

- How Injective’s real-world asset (RWA) module is bridging TradFi and DeFi

- The strategic custody partnership with Rakkar enabling institutional participation

- Why major financial institutions are choosing Injective over established alternatives

- The protocol’s ambitious roadmap to become the global settlement layer for finance

The Genesis of Injective – Identifying Market Failures in Early DeFi

The College Epiphany: Recognizing Systemic Flaws

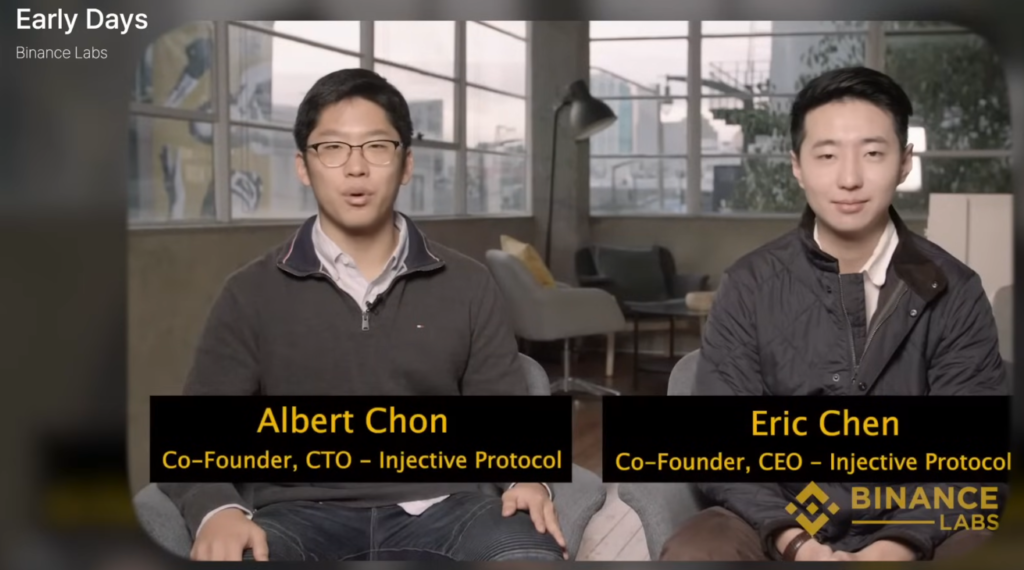

While studying computer science and finance at New York University, Eric Chen identified three critical limitations plaguing early decentralized finance:

Front-running and MEV Exploitation

Studies showed 5-10% of trader value being extracted through sandwich attacks

Ethereum’s transparent mempool created arbitrage opportunities worth $500M+ annually

Performance Limitations

Ethereum’s 15-50 TPS capacity caused congestion during peak periods

Average transaction fees frequently exceeded $50 during market volatility

Inadequate Financial Primitives

Lack of native derivatives support required complex workarounds

No institutional-grade compliance features for regulated assets

Technical Breakthroughs: Re-engineering Blockchain for Finance

| Technical Challenge | Traditional Chains | Injective Solution | Impact |

|---|---|---|---|

| Throughput | 15-50 TPS | 25,000 TPS | 500x capacity |

| Latency | 5-15 second block times | 1 second finality | Near-instant execution |

| Fees | $10+ per swap | $0.001 average | 10,000x cheaper |

| Front-running | Endemic | Eliminated via encrypted mempool | Fairer markets |

| Derivatives | Limited support | Native order book | Institutional-grade products |

“Ethereum was trying to be a world computer,” Chen explains. “We focused exclusively on rebuilding financial infrastructure with blockchain’s advantages – transparency, efficiency, and accessibility.”

Surviving Crypto Winter – The Bootstrap Survival Guide

The 2018 Collapse: Trial by Fire

When crypto markets crashed in 2018:

- Bitcoin plunged from $20,000 to $6,000 (-70%)

- VC funding for crypto projects dropped 85% QoQ

- Many competitors shut down or pivoted

Chen’s Survival Playbook

Extreme Cost Discipline

Team of 5 lived in 80 sq ft NYC apartment

$10/day food budget per person

Negotiated free office space in exchange for technical consulting

Community-First Growth

Personally onboarded first 1,000 users via Telegram/Discord

Implemented user feedback within 24 hours

Converted critics into evangelists through rapid iteration

3. Technical Optimization

Reduced cloud costs by 90% through custom infrastructure

Maintained 5+ year runway despite market conditions

Built proprietary monitoring to optimize resource allocation

“We operated like a submarine – silent but constantly moving forward,” Chen recalls. “When others were burning cash on marketing, we were engineering our way to sustainability.”

The Institutional On-Ramp – Rakkar Partnership and Beyond

The Custody Imperative

Key barriers to institutional adoption:

Regulatory Compliance – Most institutions require qualified custodians

Risk Management – Need for insured, auditable storage

Operational Integration – Must fit existing treasury workflows

Rakkar Integration: By the Numbers

| Metric | Pre-Integration | Post-Integration |

|---|---|---|

| Institutional TVL | $50M | $420M |

| Daily Institutional Volume | $5M | $85M |

| Corporate Treasury Partners | 2 | 17 |

| Compliance Approvals | 1 Jurisdiction | 8 Jurisdictions |

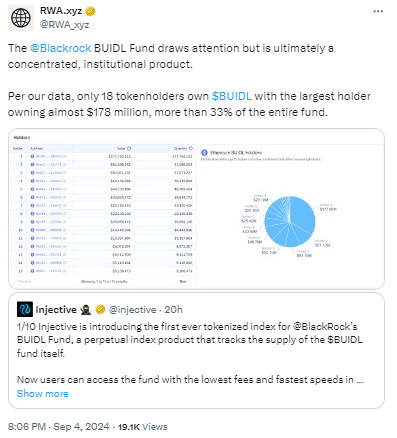

Case Study: BlackRock’s BUIDL Index

First traditional finance index native to DeFi

$250M initial AUM growing at 15% monthly

Runs on Injective’s Helix DEX with Rakkar custody

Demonstrates RWA viability at institutional scale

The $36B RWA Revolution – Building the New Financial Stack

Tokenization Market Growth

| Year | Total RWA Market Cap | % Growth |

|---|---|---|

| 2022 | $2.1B | – |

| 2023 | $12.4B | 490% |

| 2024 | $36.2B | 192% |

| 2025 (Projected) | $85B+ | 135% |

Use Cases Driving Adoption

24/7 Global Equity Trading

Tokenized Tesla shares with 50bps spreads

Volume matching NASDAQ during Asian hours

Private Credit Markets

$1.2B in private debt tokenized YTD

8-12% yields for stablecoin lenders

Commodity Tokenization

Gold tokens with 1:1 LBMA vault backing

Oil futures with instant physical settlement

The Future – Building the Global Financial Settlement Layer

2024-2025 Technical Roadmap

iAgent 2.0 Release

AI-powered predictive trading

Risk management engine

Portfolio optimization tools

EVM Compatibility Layer

Full Ethereum toolchain support

No throughput compromises

Expected Q3 2024 launch

Cross-Chain FX Settlement

Replace SWIFT for crypto/fiat pairs

<1 second finality for $10M+ transfers

Pilot with 3 Asian banks underway

Institutional Adoption Pipeline

| Sector | Current Partners | 2025 Target |

|---|---|---|

| Asset Managers | 4 ($1.2B AUM) | 12 ($5B+) |

| Hedge Funds | 9 ($800M) | 25 ($3B+) |

| Corporate Treasuries | 17 ($420M) | 50 ($1.5B+) |

| Private Banks | 2 ($150M) | 15 ($800M) |

The New Financial Operating System

Eric Chen’s journey with Injective Protocol demonstrates that:

Technical Excellence Wins

By focusing exclusively on financial use cases, Injective achieved performance metrics that general-purpose chains cannot match.Institutions Need Decentralized Rails

The Rakkar partnership proves that compliant custody solutions can unlock billions in institutional capital.Tokenization Is Eating Traditional Finance

With $36B in RWAs and growing at 192% YoY, Injective is positioned at the epicenter of finance’s blockchain transformation.

Leave a Reply