Kristy Kim, the founder and CEO of TomoCredit, has built an AI-powered fintech startup that caters to a significant yet underserved market—immigrants and international students in the U.S. Her journey is a tale of resilience, grit, and ambition. By targeting people without a traditional U.S. credit history, TomoCredit offers a solution to immigrants who often face hurdles in accessing credit cards, auto loans, and mortgages. In this blog, we will explore how Kristy Kim turned personal challenges into a multi-million-dollar fintech enterprise, growing her company from scratch without any paid marketing in the early stages.

TomoCredit – https://tomocredit.com/

TomoCredit (Instagram) – @tomocredit

Kristy Kim (Instagram) – @kickasskristy

Kristy Kim (X) – https://x.com/kristykim1015

From Rejection to Innovation: The Birth of TomoCredit

Kristy’s entrepreneurial journey began out of frustration with a system that seemed stacked against her. As an immigrant herself, she faced repeated rejections while trying to access basic financial services like credit cards and loans. This unfair treatment, combined with the rescinded job offer from Goldman Sachs due to her visa status, ignited her desire to solve the problem for others facing the same obstacles.

Kristy and her team, made up of immigrants, decided to build a fintech company focused on offering a credit card solution for those without a credit score. They wanted to create a platform where the lack of a credit history wouldn’t stand in the way of accessing financial services.

TomoCredit’s Unique Value Proposition

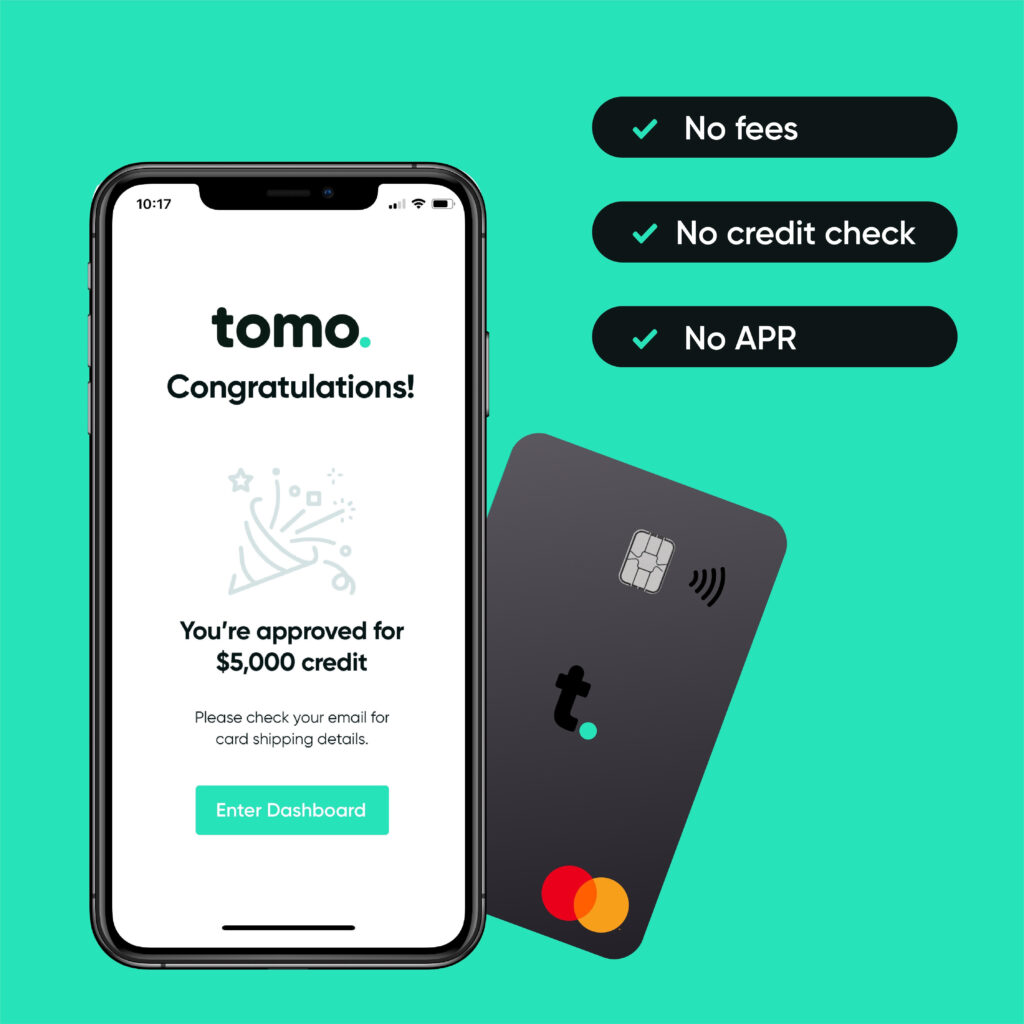

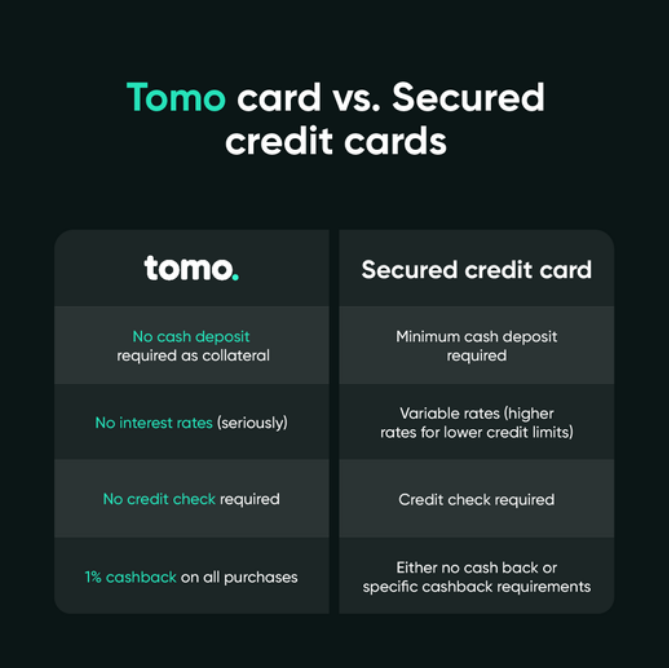

The key innovation behind TomoCredit is its reliance on bank account data rather than credit scores to assess financial responsibility. Instead of using the traditional FICO score model, which penalizes people with little or no credit history, TomoCredit has developed its own scoring system called the Tomo Score. This proprietary system evaluates an individual’s bank account activity, income stability, and spending patterns to determine their creditworthiness.

How TomoCredit Works:

- No Credit Score Needed: Unlike traditional credit cards, TomoCredit offers its services to immigrants, international students, and even Americans with no credit score.

- Data-Based Approval: Users can link multiple bank accounts (domestic or international) to the TomoCredit platform, which then analyzes their financial data—like income, spending power, and disposable income.

- Tomo Score: Tomo uses this data to generate a unique credit score called the Tomo Score, which acts as an alternative to the traditional FICO score, providing access to credit based on actual financial health rather than credit history.

Overcoming Challenges: The Immigrant Struggle

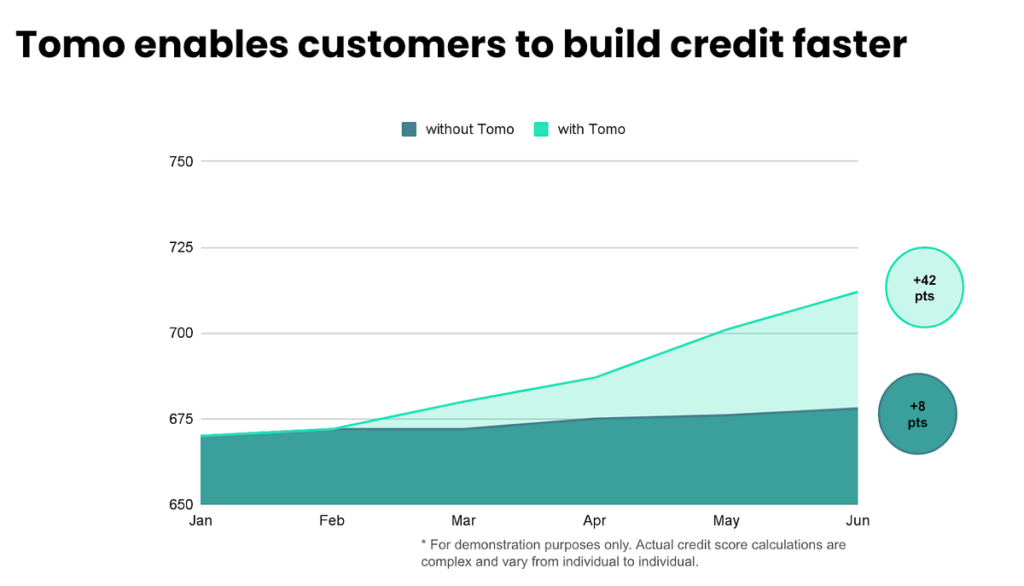

As Kristy notes, one of the biggest barriers for immigrants is that they don’t have the advantage of building a credit history at a young age. While U.S. citizens may begin their credit journeys as teenagers, many immigrants start with a credit age of zero, putting them at a significant disadvantage when applying for loans or credit cards later in life.

TomoCredit seeks to fill that gap, providing a credit solution for those who lack the time or opportunity to build traditional credit scores. Kristy’s personal experiences as an immigrant made her empathetic toward her target audience, driving her to create a solution for people just like her—people who work hard but face systemic barriers to financial inclusion.

Navigating the Fintech Industry: Building Relationships with Banks

Despite her lack of experience in consumer banking, Kristy was relentless in meeting with industry leaders. She sought guidance from executives at companies like American Express, Barclays, and Wells Fargo. Initially, she faced resistance, as no bank wanted to take the first step in approving customers without a credit score.

Kristy quickly realized that if banks were unwilling to take the risk, TomoCredit would have to lead the charge. This led to Tomo’s decision to develop not only their own scoring system but also their own lending capabilities.

The Turning Point: Barclays Investment

TomoCredit’s early success in attracting customers caught the attention of major financial institutions. One key milestone was securing investment from Barclays UK Bank. This partnership helped Tomo build credibility, attract further interest from banks, and accelerate growth.

Product-Market Fit: Scaling Through COVID-19

The initial product-market fit for TomoCredit was almost immediate. Kristy’s team was fortunate that their core business model—targeting immigrants and those without a credit score—resonated with a large audience. This early traction was a significant blessing, as the company doubled and tripled down on their original idea without the need for massive pivots.

In fact, during the COVID-19 pandemic, TomoCredit grew by 400%, with another 200% growth the following year. By staying true to its mission and focusing on its core market, TomoCredit was able to scale effectively even in challenging times.

The Tech Behind TomoCredit: Data-Driven Decisions

One of the key pillars of TomoCredit’s business model is the Tomo Score, which leverages financial data instead of credit history. This data-driven approach is a game-changer in fintech, allowing TomoCredit to approve high-quality customers who have been overlooked by traditional banks.

Key Aspects of the Tomo Score:

- Affordability: Can the applicant afford the loan? This is evaluated through a combination of bank account data, including cash flow and spending patterns.

- Sustainability: Is the applicant’s income stable? TomoCredit looks at the long-term stability of income and spending habits.

- Willingness to Pay: This is perhaps the trickiest part to gauge. While someone may have stable finances, their willingness to repay loans is another factor that the Tomo Score accounts for through predictive modeling.

Risk Management: Balancing Innovation and Caution

While TomoCredit aimed to be a first mover in lending to people without credit scores, Kristy knew the importance of maintaining a strong risk management strategy. The company brought in industry veterans from American Express, Citi Bank, and Wells Fargo to develop a robust risk management team. This team ensured that the company’s underwriting was both innovative and cautious, enabling TomoCredit to thrive without taking on undue risk.

Expanding the Ecosystem: Future Plans for TomoCredit

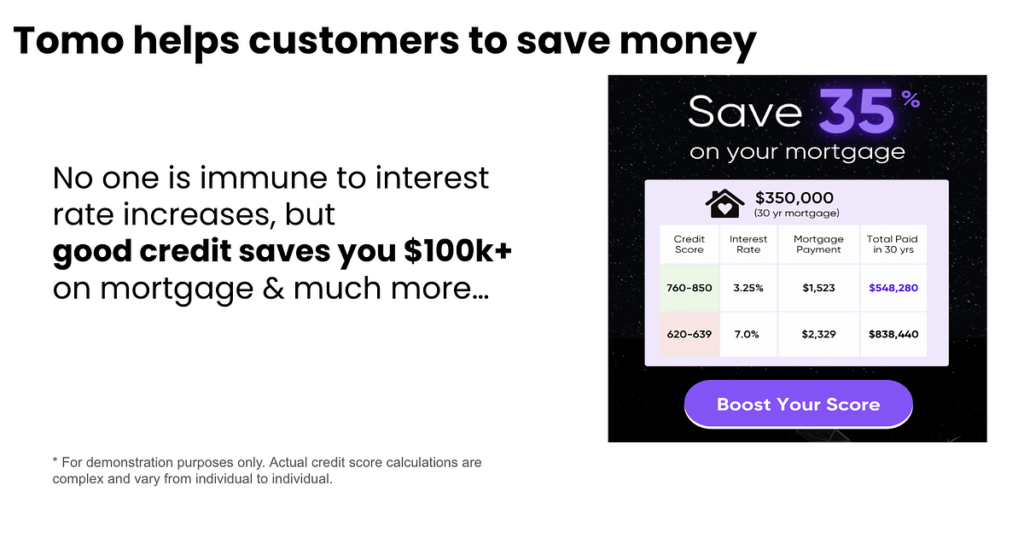

Looking ahead, Kristy envisions TomoCredit becoming a major player in the U.S. financial ecosystem. She sees the company evolving into a trusted brand for immigrants—offering more than just credit cards but a full suite of financial services like auto loans, apartment rentals, and mortgages.

TomoCredit’s mission remains clear: Empower immigrants and international students by giving them the financial tools they need to succeed in the U.S. As Kristy says, “No one comes to the U.S. just to get a credit card, but it’s a tool we all need to build a better tomorrow.”

Key Takeaways for Entrepreneurs

Kristy’s journey provides several valuable lessons for aspiring entrepreneurs:

- Turn Personal Pain into Innovation: Kristy’s struggles as an immigrant became the foundation for TomoCredit. Identify the problems that affect you and turn them into business opportunities.

- Don’t Wait for Industry Validation: Traditional banks weren’t willing to take a chance on Kristy’s idea, so she created her own solution. Sometimes, you have to be the first mover.

- Focus on Strengths, Not Weaknesses: Kristy highlights the importance of focusing on what you’re good at and hiring people who complement your skills. This approach is key to building a successful team.

- Data is the Future: Leveraging alternative data sources, like bank account data instead of credit history, has allowed TomoCredit to thrive. Innovative uses of data can unlock new opportunities in fintech.

Leave a Reply