General Info

Founder: Elon Musk, Peter Thiel, Max Levchin

CEO: Alex Chriss (46 yo)

Started in: December 1998, Palo Alto, California, United States

Employees: Approx. 27,000 employees globally

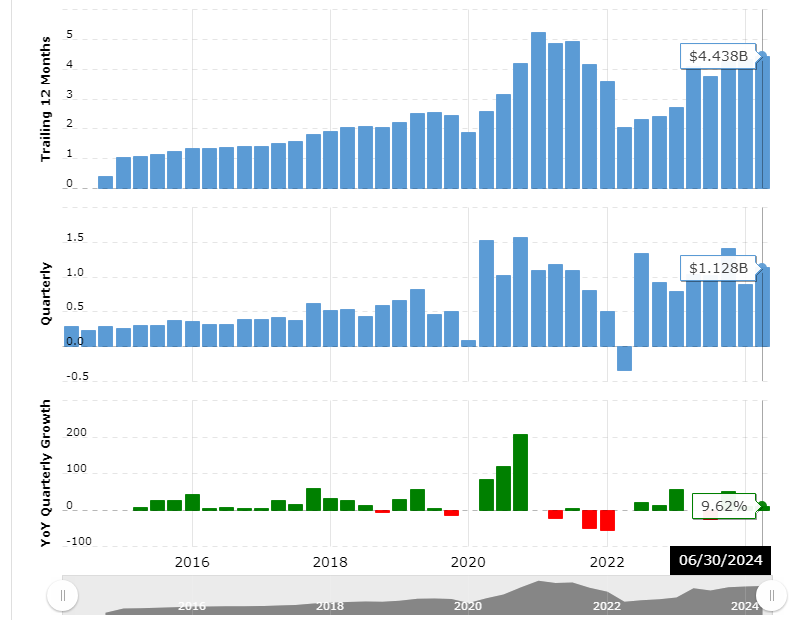

Financial Info

Revenue/Quarter: Approx $7.7 billion (as of Q1 FY24) (up 9.0%)

Net Income/Quarter: Approx $1.128B (as of Q1 FY24) (up 9.2% from 2023)

Profit margin: 14.31% (as of Q1 FY24) (up from 19.42% in March 30, 2024)

The Origin Story: From Confinity to PayPal

PayPal’s journey from its inception as a small security software company to becoming one of the most recognized financial technology companies in the world is filled with strategic pivots, visionary leadership, and significant milestones. Founded in December 1998 as Confinity by Max Levchin, Peter Thiel, and Luke Nosek, the company’s original focus was far from the digital payments empire it would become.

Early Days of Confinity

Confinity began as a software company developing encryption technology for handheld devices, an area with increasing interest during the late 1990s. However, the founders quickly realized that the broader market demand was shifting, and they started experimenting with digital payment systems, specifically through personal digital assistants (PDAs). At the time, there was a growing need for a way to transfer money easily and securely between individuals online, particularly as e-commerce began to rise.

- Stat: By the end of 1999, the company shifted focus entirely toward developing a digital wallet and peer-to-peer (P2P) payment system.

- Stat: The original Confinity P2P service allowed Palm Pilot users to “beam” money to each other, but the service soon evolved into the internet-based PayPal platform we know today.

Merger with X.com (1999-2000)

* Left – (X.com), Right – (Confinity) {Credit: MagnatesMedia (YT)}

* Left – (X.com), Right – (Confinity) {Credit: MagnatesMedia (YT)}

In March 2000, Confinity merged with X.com, an online banking company founded by Elon Musk in 1999. X.com had also been experimenting with online payments, and the two companies saw the potential synergy between their platforms.

- Stat: At the time of the merger, X.com had raised over $25 million in venture capital, a significant war chest that allowed the newly merged company to rapidly expand its operations.

- Stat: The combined company had nearly 20,000 customers, many of whom were part of the burgeoning e-commerce industry, which was growing at an annual rate of around 33% during the early 2000s.

While Elon Musk initially took the helm of the merged company, the platform’s evolution toward becoming a digital payment system caused internal disagreements about the future direction. Musk was eventually ousted by the board in favor of Peter Thiel, who became the CEO in September 2000, solidifying the company’s focus on PayPal as a digital wallet and payment processor.

Early Growth and Adoption

The rebranded PayPal began to see explosive growth soon after the merger, largely driven by its adoption on eBay. As e-commerce gained traction, particularly through auction platforms like eBay, the need for a simple, reliable method of payment became critical. PayPal’s integration with eBay provided the perfect solution, allowing buyers and sellers to transact easily.

- Stat: By 2001, PayPal had more than 1 million users, processing over $3 billion in transactions annually. It was growing at a rate of 10% per week during its early stages.

- Stat: More than 70% of eBay auctions were using PayPal for transactions by the end of 2001, making it the dominant payment solution on the platform.

To fuel its growth, PayPal raised multiple rounds of funding. One of its largest early investors was Peter Thiel’s venture capital firm, which injected around $100 million into the company.

PayPal’s IPO (2002)

In February 2002, PayPal went public, raising $61 million in its initial public offering (IPO). The IPO valued the company at approximately $1.2 billion, a significant achievement for a relatively young tech company at the time. PayPal’s stock price surged by more than 50% on its first day of trading, reflecting the market’s belief in the future potential of digital payments.

- Stat: On the day of its IPO, PayPal’s share price increased from $13 to $20, a 54% rise, indicating strong investor confidence.

- Stat: PayPal had over 15 million active users by the time of its IPO, with approximately 70% of its transactions occurring through eBay.

eBay Acquisition (2002)

The pivotal moment in PayPal’s early growth came in July 2002 when eBay acquired PayPal for $1.5 billion in stock. PayPal had emerged as the dominant payment solution on eBay, and the acquisition cemented its role as the primary payment processor for eBay’s global user base.

- Stat: The acquisition gave eBay a 90% market share in online auctions and helped consolidate its payment operations, reducing reliance on traditional credit card processors.

- Stat: At the time of the acquisition, PayPal’s transaction volume was growing at an annual rate of 60%, driven by its expanding base of eBay users, with over 20 million registered accounts globally.

Key Early Moves (1999-2002)

Several strategic moves played crucial roles in shaping PayPal’s early trajectory:

- Expansion to eBay (1999-2000) – Early adoption of PayPal by eBay sellers was largely organic. PayPal offered a seamless alternative to checks and money orders, which were common at the time but less convenient. eBay initially experimented with its own payment solution, Billpoint, but PayPal’s viral user adoption on the platform quickly overtook eBay’s internal service.

- Stat: By 2001, over 80% of eBay sellers preferred using PayPal over other payment methods, particularly for smaller transactions under $500, where speed and convenience were critical.

- Referral Program (2000) – PayPal implemented one of the first viral referral programs in Silicon Valley. The program rewarded users with $10 for signing up and an additional $10 for referring friends, a strategy that led to massive user growth in a short time.

- Stat: This referral program cost the company approximately $60 million in its early years but was directly responsible for bringing in over 7 million new users by the end of 2000.

- Combatting Fraud (2001-2002) – One of PayPal’s most significant challenges was managing fraud and chargebacks, particularly as its user base grew. In response, PayPal invested heavily in anti-fraud technology, implementing machine learning algorithms to detect suspicious activity, and by 2002 had reduced fraud-related losses to below 0.5% of total payment volume.

- Stat: In 2001, PayPal’s fraud rate was around 1.8%, but by the time of its acquisition by eBay, this number had dropped to 0.39%, a testament to its focus on security.

- Geographical Expansion (2002) – In the months following its IPO, PayPal expanded into international markets, including the United Kingdom, Germany, and Canada. The company’s ability to facilitate cross-border payments quickly became one of its unique selling points, helping to fuel additional growth.

- Stat: By 2002, over 25% of PayPal’s transaction volume was coming from international markets, an early indicator of its potential for global expansion.

Post-eBay: PayPal as a Standalone Company

After its 2015 spinoff from eBay, PayPal began a new chapter, emerging as an independent financial powerhouse. The decision to separate was motivated by the recognition that PayPal had outgrown eBay’s ecosystem, expanding its services far beyond a payment processor for auction sites.

The Independence Move

In July 2015, PayPal officially became a standalone public company again, listing on the NASDAQ under the ticker symbol PYPL. The initial market reaction was overwhelmingly positive, with PayPal’s shares soaring on its first day of trading.

- Stat: PayPal’s initial market capitalization after the split was over $50 billion, larger than eBay’s own valuation.

- Stat: PayPal immediately had more than 165 million active user accounts, processing 4 billion transactions annually across 203 markets.

The separation gave PayPal the flexibility to focus on its global ambitions and expand its footprint into new industries, including peer-to-peer payments, international remittances, and business solutions.

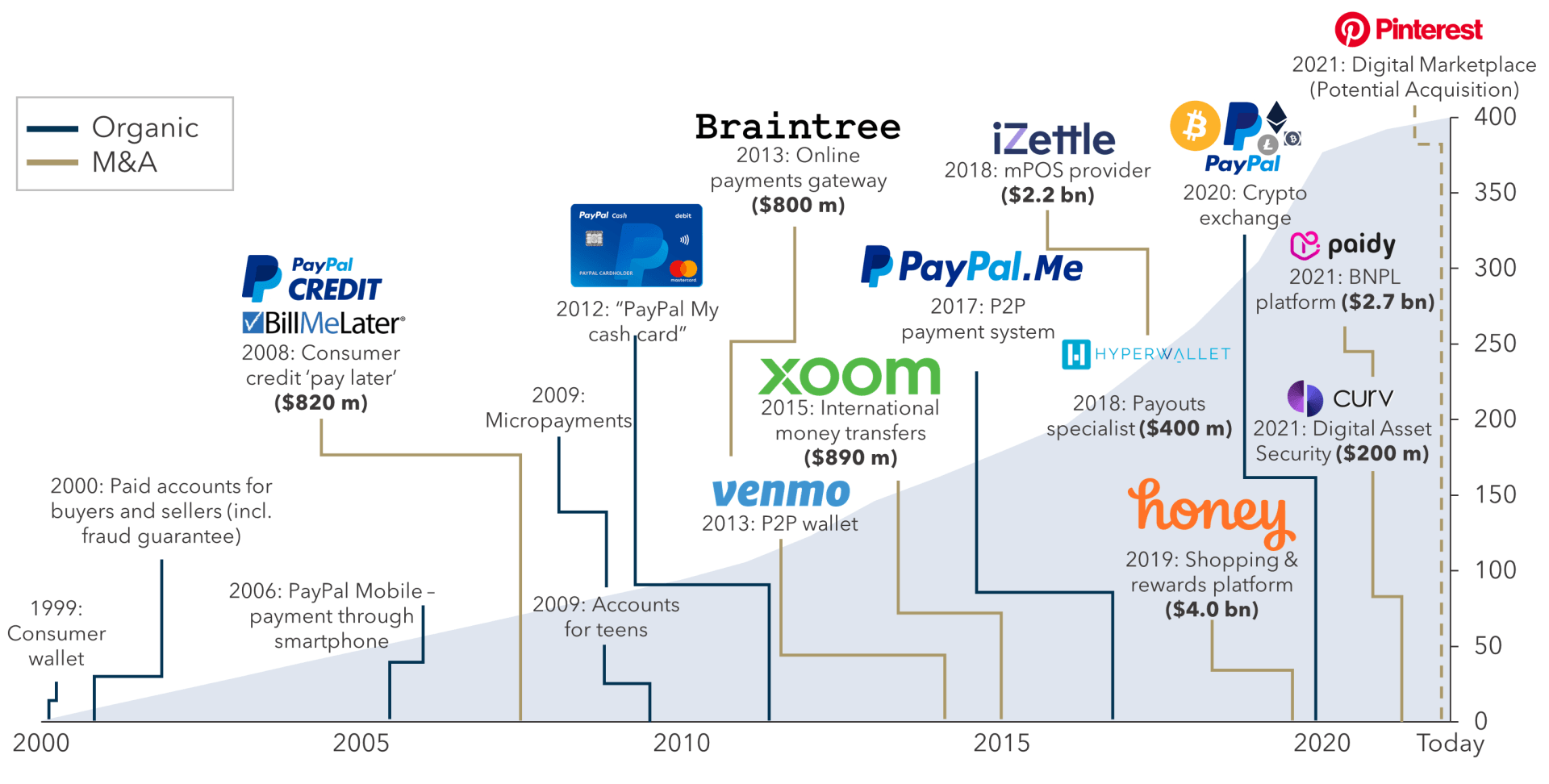

Accelerated Growth & Key Acquisitions

PayPal didn’t waste time in building its empire after the split. It embarked on an aggressive acquisition strategy to bolster its offerings and solidify its market dominance.

- Acquisitions: In 2015, PayPal acquired Xoom, a global money transfer service, for $890 million, expanding its international payments presence. Later acquisitions included Swift Financial (2017) for small business lending, iZettle (2018) for point-of-sale solutions, and Honey (2020) for e-commerce optimization, valued at $4 billion.

- Stat: By 2020, PayPal had processed $936 billion in total payment volume (TPV), up from $451 billion in 2017, highlighting its rapid expansion.

With strategic moves into mobile payments and fintech, PayPal began seeing impressive growth in its user base and transaction volume, largely driven by innovations like Venmo, its P2P payment app.

- Stat: Venmo, acquired through the Braintree deal in 2013, exploded in popularity, processing $159 billion in transactions in 2020, up from just $12 billion in 2015.

Expansion into New Markets & Partnerships

In the years following its independence, PayPal formed critical partnerships that allowed it to expand its reach and adapt to the changing landscape of digital payments. The company partnered with major players like Visa, Mastercard, and Apple, which helped drive PayPal’s acceptance across new merchants and broadened its user base globally.

- Stat: By 2021, PayPal had over 400 million active user accounts worldwide and generated $25.4 billion in revenue, up from $9.24 billion in 2015.

New Ventures: Buy Now, Pay Later & Cryptocurrency

PayPal entered the booming Buy Now, Pay Later (BNPL) market in 2020, positioning itself as a leader in short-term financing. This offering allowed users to split purchases into installments, quickly gaining popularity among consumers looking for flexible payment options.

- Stat: In the first year of its BNPL launch, over $750 million in transactions were processed via PayPal’s BNPL service.

In addition, PayPal began embracing cryptocurrency, allowing users to buy, sell, and hold digital currencies like Bitcoin directly through the PayPal platform, marking another significant expansion into emerging financial technologies.

- Stat: By 2022, more than 30 million PayPal users had engaged in cryptocurrency transactions.

PayPal Today

Since its independence from eBay, PayPal has grown to become one of the most prominent names in the fintech world, continuing to evolve and innovate in digital payments, international transfers, and e-commerce.

- Stat: In 2023, PayPal’s total payment volume reached a staggering $1.36 trillion, with the company managing over 5 billion transactions annually.

PayPal’s ability to adapt to market changes and rapidly integrate new services has been a driving force behind its sustained growth, making it a dominant player in the global financial technology space.

Key Business Divisions and Revenue Streams

PayPal’s diverse portfolio of business divisions and revenue streams has been a driving factor behind its remarkable growth as a fintech leader. As of 2023, PayPal has evolved from a simple digital payment service into a multifaceted financial services company, with income generated from a wide range of sources. Each division plays a critical role in PayPal’s broader strategy, allowing the company to remain competitive in the rapidly evolving fintech market.

Core Payment Processing

At the heart of PayPal’s business model remains its core payment processing services, which include transaction fees from consumers and merchants. PayPal’s main revenue driver comes from fees collected when users send and receive payments through its digital wallet and merchant services.

- Stat: As of 2022, transaction fees accounted for over $24.3 billion, or approximately 87% of PayPal’s total revenue.

- Stat: PayPal processed over $1.36 trillion in total payment volume (TPV) in 2023, a significant increase from $936 billion in 2020, driven by higher merchant adoption and user growth.

Peer-to-Peer (P2P) Payments

PayPal’s peer-to-peer payment services, particularly through its Venmo platform, have become a significant part of its business. Venmo has been a major driver of engagement, especially among younger demographics.

- Stat: Venmo processed $244 billion in transactions in 2021, representing a 29% year-over-year growth, contributing significantly to PayPal’s expanding user base.

- Stat: Venmo’s monetization strategy, including fees from instant transfers and crypto purchases, generated over $850 million in revenue by 2022.

Buy Now, Pay Later (BNPL)

The introduction of Buy Now, Pay Later (BNPL) services has proven to be a lucrative revenue stream for PayPal. This offering allows consumers to split their purchases into installment payments without interest, providing both flexibility and convenience. The growth of BNPL has been accelerated by increased demand for short-term financing solutions.

- Stat: By 2021, PayPal’s BNPL services were used by more than 12 million consumers across the globe, and in 2022, PayPal processed $3.5 billion in BNPL transactions.

- Stat: PayPal’s BNPL services contributed over $1.5 billion in revenue by the end of 2022.

Merchant Services

PayPal also generates significant revenue from its merchant services, which provide businesses with payment gateways, invoicing, and subscription tools. This division has been pivotal in PayPal’s B2B (business-to-business) growth and its expansion into e-commerce.

- Stat: PayPal’s merchant services division generated over $3 billion in revenue in 2021, and by 2022, it had onboarded more than 35 million merchants globally.

- Stat: Approximately 77% of PayPal’s TPV comes from its merchant services, showing its critical role in e-commerce and online payments.

Xoom and Cross-Border Transactions

PayPal’s Xoom service, which facilitates international money transfers, plays a crucial role in its cross-border payment offerings. These services are essential for PayPal’s expansion into emerging markets and its global remittance strategy.

- Stat: Xoom handled $14 billion in cross-border payments in 2021, with a growth rate of 18% year-over-year.

- Stat: Cross-border transactions represented around 20% of PayPal’s total payment volume in 2022, generating over $2.5 billion in fees.

Subscription and Value-Added Services

In addition to transaction-based revenue, PayPal has developed subscription and value-added services for merchants and consumers. These include premium business tools, fraud detection software, and credit solutions for small businesses.

- Stat: PayPal’s value-added services generated more than $2.2 billion in 2022, growing at a rate of 15% annually.

- Stat: PayPal’s small business lending through services like PayPal Working Capital has provided over $20 billion in loans to small businesses as of 2022.

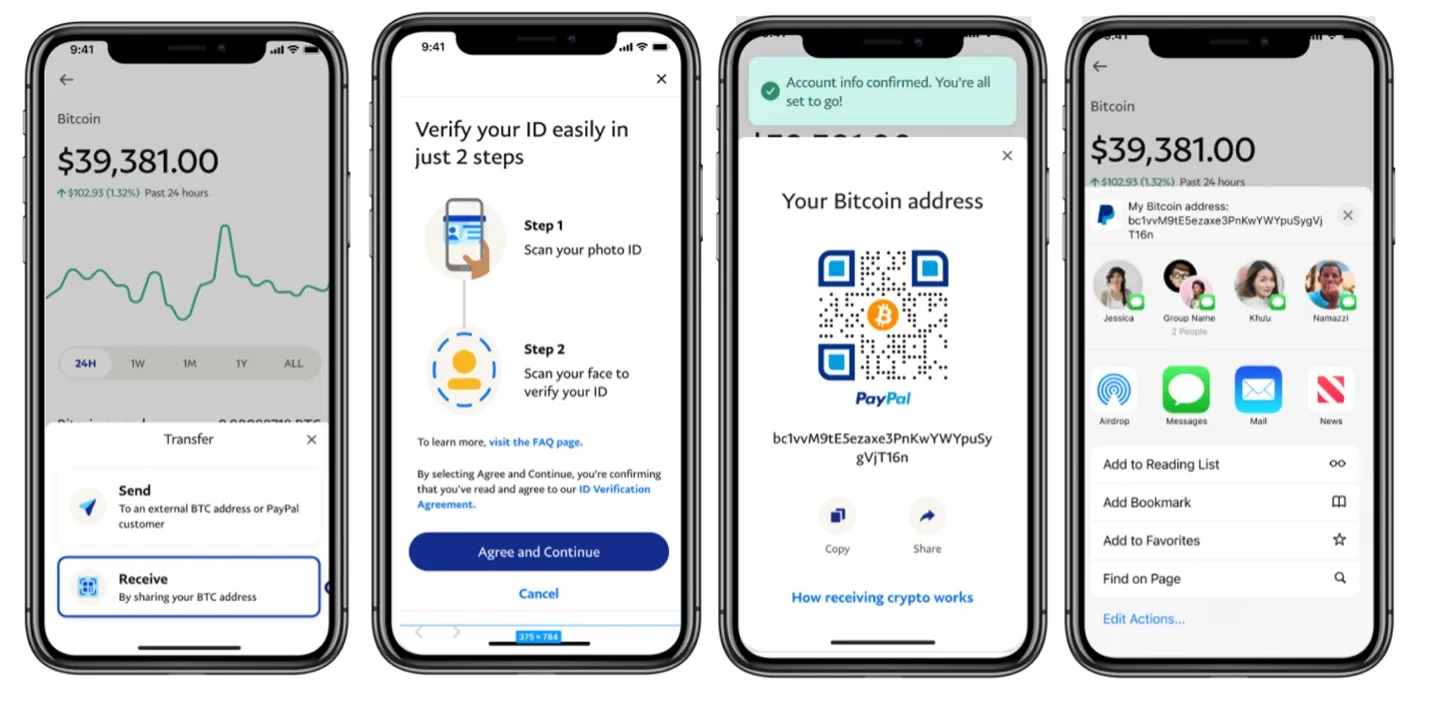

Cryptocurrency Services

In recent years, PayPal has entered the cryptocurrency space, allowing users to buy, sell, and hold digital assets like Bitcoin and Ethereum. This new division has created additional revenue streams through transaction fees and crypto services.

* Transferring crypto into PayPal from an external wallet or exchange

- Stat: By 2022, PayPal had facilitated more than $2 billion in cryptocurrency transactions, with 30 million users engaging in crypto trades.

- Stat: PayPal earned approximately $600 million from cryptocurrency transactions in its first full year of offering the service.

Interest Income and Financial Products

PayPal’s interest income from its financial services, such as its consumer and merchant credit offerings, also adds a layer of revenue. PayPal Credit and Venmo Credit services provide interest-bearing lending options to customers, further diversifying the company’s revenue streams.

- Stat: PayPal earned over $1.2 billion in interest income in 2022 from its various lending and credit offerings.

Growth Through Acquisitions

PayPal’s aggressive acquisition strategy has been pivotal in expanding its services, entering new markets, and maintaining its dominance in the fintech industry. Over the years, PayPal has acquired several companies that have bolstered its capabilities across digital payments, peer-to-peer transactions, e-commerce, and financial services. These acquisitions have allowed PayPal to stay competitive and continue growing in the rapidly evolving financial technology landscape.

Acquiring Braintree and Venmo (2013)

One of PayPal’s most significant and impactful acquisitions was its purchase of Braintree in 2013 for $800 million. Braintree brought with it the peer-to-peer payment service Venmo, which has since become one of PayPal’s most recognizable brands, particularly among younger consumers. Venmo’s popularity as a social payment app skyrocketed, allowing PayPal to tap into the growing peer-to-peer (P2P) payments market.

- Stat: Venmo’s user base has grown to over 90 million active accounts by 2022, with its transaction volume reaching $244 billion in 2021.

- Stat: Venmo contributed to PayPal’s growth in P2P payments, accounting for approximately $850 million in revenue in 2022, a 29% year-over-year increase.

Xoom (2015) – Cross-Border Payments Expansion

In 2015, PayPal acquired Xoom, a digital money transfer service focused on cross-border payments, for $890 million. This acquisition was crucial in expanding PayPal’s international footprint, particularly in the global remittance market, where cross-border transactions play a significant role.

- Stat: Xoom enabled PayPal to access a $700 billion global remittance market and facilitated international money transfers to over 130 countries.

- Stat: By 2022, Xoom had processed more than $14 billion in cross-border payments, with around 20% of PayPal’s total payment volume (TPV) coming from international transactions.

iZettle (2018) – Strengthening In-Store Payments

In 2018, PayPal made one of its largest acquisitions by purchasing iZettle, a Swedish payments company known for its mobile card readers, for $2.2 billion. This acquisition allowed PayPal to enter the in-store payments market, providing merchants with hardware solutions for accepting payments in brick-and-mortar locations. It also significantly enhanced PayPal’s presence in Europe and Latin America.

- Stat: With the iZettle acquisition, PayPal gained access to 500,000 small businesses across Europe and Latin America, increasing its merchant service portfolio.

- Stat: By 2020, in-store payments processed through iZettle contributed to PayPal’s expanding merchant services, helping to drive the company’s annual revenue beyond $21 billion.

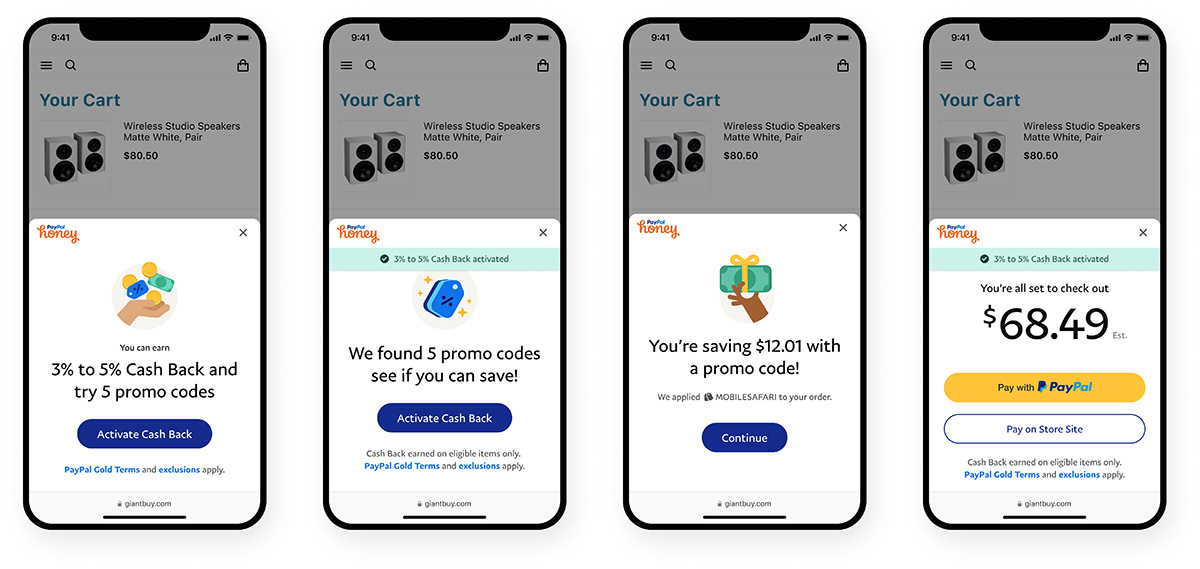

Honey (2020) – Expanding Consumer Services

In a move to enhance its consumer offerings and deepen customer engagement, PayPal acquired Honey, a browser extension that helps users find discounts and coupons online, for $4 billion in 2020. Honey enabled PayPal to enter the retail market by offering customers savings and rewards, further aligning itself with e-commerce growth trends.

- Stat: Honey had over 17 million monthly active users at the time of acquisition, with 30,000+ retailers leveraging its platform for marketing and promotional activities.

- Stat: Honey’s acquisition allowed PayPal to engage with consumers earlier in their shopping journey, generating $500 million in additional revenue in 2021 through increased user activity and e-commerce transactions.

Paidy (2021) – Strengthening Buy Now, Pay Later (BNPL)

PayPal’s acquisition of Paidy, a Japanese BNPL service, for $2.7 billion in 2021 was a strategic move to strengthen its position in the growing Buy Now, Pay Later (BNPL) market. The acquisition expanded PayPal’s global reach into Japan, one of the world’s largest e-commerce markets, and helped diversify its BNPL offerings.

- Stat: Paidy had 6 million active users in Japan at the time of the acquisition, and its BNPL model contributed to PayPal’s growing portfolio of financial products.

- Stat: The global BNPL market was valued at over $120 billion in 2022, with PayPal’s BNPL services, including Paidy, processing over $3.5 billion in transactions that year.

Hyperwallet (2018) – Enhancing Global Payout Capabilities

Another important acquisition was PayPal’s purchase of Hyperwallet in 2018 for $400 million. Hyperwallet is a global payout platform that allows businesses to send payments to individuals around the world, particularly freelancers and gig economy workers. This acquisition helped PayPal enhance its global payout capabilities, especially in the growing gig economy.

- Stat: Hyperwallet expanded PayPal’s payout services to over 200 countries, enhancing its ability to process cross-border payments efficiently.

- Stat: By 2020, Hyperwallet’s platform had processed $10 billion in payments to freelancers and gig workers, further establishing PayPal as a key player in the global payments ecosystem.

Strategic Synergy and Impact

PayPal’s acquisitions have not only diversified its product offerings but also strengthened its market position in key areas such as peer-to-peer payments, international money transfers, in-store payments, and BNPL services. These strategic moves have helped PayPal remain competitive in an increasingly crowded fintech landscape.

- Stat: PayPal’s total revenue increased from $17.8 billion in 2019 to $27 billion in 2022, driven in large part by the growth of acquired companies like Venmo, Xoom, and Honey.

Stat: By 2022, PayPal had over 435 million active accounts globally, a significant increase fueled by the contributions of its acquisitions.

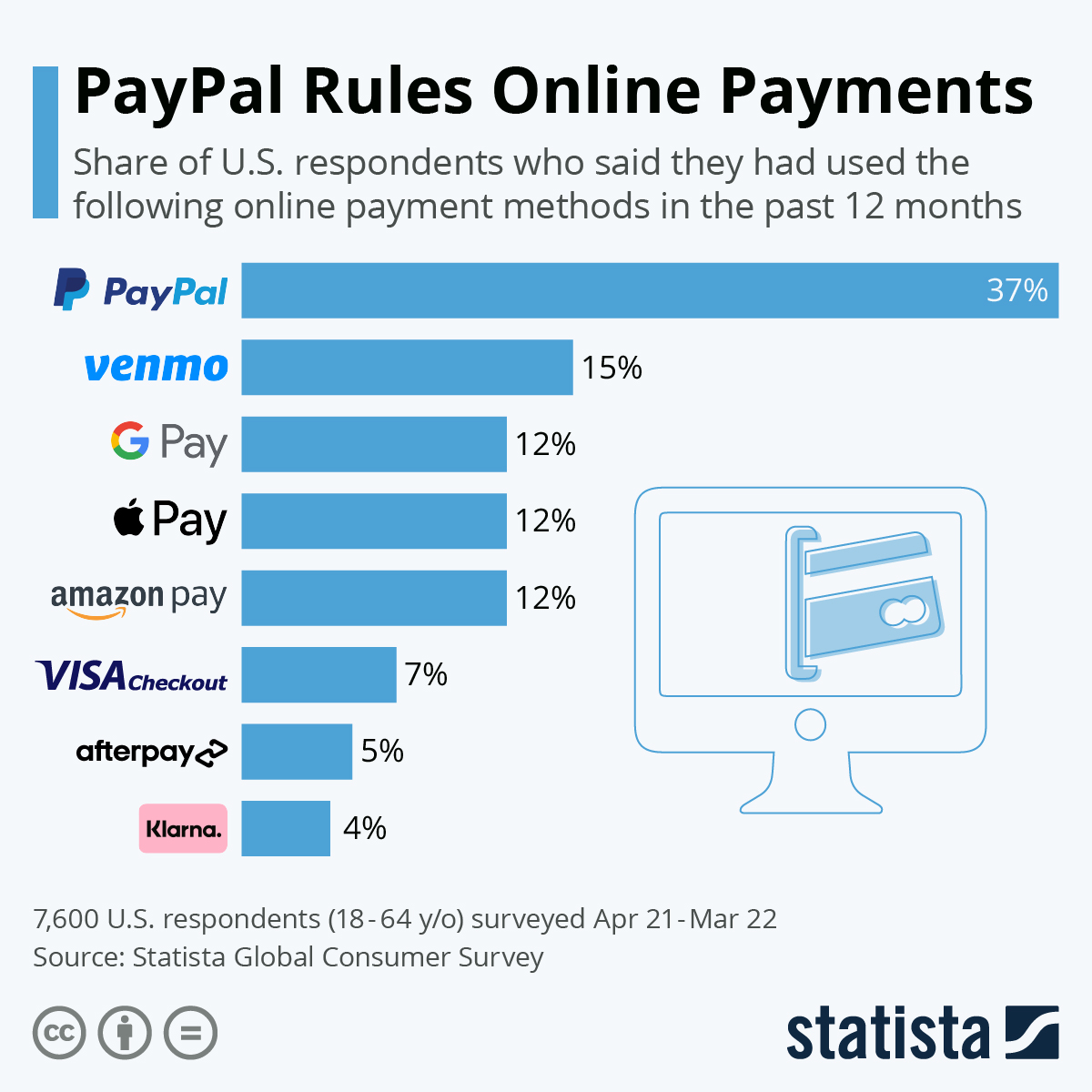

PayPal’s Competitive Landscape: Winning the Digital Payment Wars

As one of the pioneers of digital payments, PayPal has long been at the forefront of the fintech industry. However, it operates in an intensely competitive landscape, where both established financial institutions and innovative startups are vying for dominance. PayPal’s ability to maintain its leadership position has been a result of strategic innovation, adaptability, and expanding its global reach. This section delves into the competitive forces PayPal faces and how it continues to differentiate itself amid fierce competition.

Major Competitors:

PayPal’s competition comes from a range of players, including traditional banks, tech giants, and fintech disruptors. Some of its key competitors are:

- Square (now Block): Known for its point-of-sale (POS) systems and Cash App, Square has made significant strides in peer-to-peer (P2P) payments and small business services.

- Stat: In 2021, Square reported annual revenue of $17.66 billion, driven by Cash App’s growth, which processed $3 billion in gross payment volume (GPV) per quarter.

- Stripe: A leading online payment processor for businesses, Stripe has focused on developer-friendly APIs and international markets, becoming a favorite among startups and large enterprises alike.

- Stat: Stripe processed $640 billion in payments globally in 2021, making it a strong contender in the online payments space.

- Apple Pay and Google Pay: Both tech giants have developed mobile wallet solutions that allow consumers to make contactless payments through their smartphones. Their massive user bases give them an edge in scaling these payment platforms.

- Stat: As of 2022, Apple Pay had over 507 million users, and 70% of US retailers accepted Apple Pay, with $90 billion in annual transaction volume globally.

- Traditional Banks: Many banks have entered the digital payments arena with their own online transfer services, such as Zelle, which offers instant bank-to-bank transfers.

- Stat: Zelle saw $490 billion in payments in 2021, nearly double PayPal’s domestic peer-to-peer (P2P) payments.

PayPal’s Competitive Edge

Despite facing pressure from these companies, PayPal has several strategic advantages that enable it to stay ahead in the competitive digital payment wars.

- Global Reach and Ecosystem PayPal’s international presence and extensive product ecosystem set it apart. While competitors like Square primarily focus on the US, PayPal operates in over 200 markets worldwide, enabling cross-border payments with ease. The combination of PayPal, Venmo, Xoom, Braintree, and Honey gives PayPal a unique advantage by offering an all-encompassing payment solution that caters to individuals, businesses, and merchants globally.

- Stat: PayPal processed $1.36 trillion in total payment volume (TPV) in 2022, with 25% of that coming from international markets.

- Stat: PayPal’s active user base reached 435 million in 2022, outpacing most competitors in both developed and emerging markets.

- Brand Trust and Ubiquity One of PayPal’s key strengths lies in its brand recognition and trust. Established in 1998, PayPal is one of the most widely recognized and trusted digital payment brands, with consumers valuing its security, ease of use, and buyer protection features. This trust has allowed PayPal to become the go-to payment option for many e-commerce platforms.

- Stat: By 2022, PayPal was accepted by 76% of the top 500 internet retailers in the US, significantly higher than Apple Pay (22%) and Google Pay (16%).

- Multi-Sided Platform Strategy PayPal’s platform-based approach serves both merchants and consumers, enabling it to capture revenue from both sides of the transaction. PayPal’s comprehensive service offerings—ranging from point-of-sale systems to online checkout integrations, and P2P payments to merchant lending—create a robust ecosystem that fosters customer retention and growth.

- Stat: PayPal’s merchant services division generated $23 billion in revenue in 2022, while its P2P services (including Venmo and Xoom) processed over $350 billion in payments.

- Innovation in Financial Products PayPal has successfully kept pace with the rapidly changing fintech landscape through continuous innovation. One of the most significant areas of growth has been in Buy Now, Pay Later (BNPL) services, a rapidly expanding market driven by the demand for flexible consumer payment options.

- Stat: PayPal’s BNPL services processed over $4.5 billion in transactions in 2022, with over 55 million consumers opting for BNPL at checkout.

Navigating the Threat of Disruption

While PayPal maintains a dominant position, it is constantly under pressure to fend off threats from newer fintech entrants. The rise of cryptocurrency, decentralized finance (DeFi), and blockchain technology is reshaping the financial services sector, and PayPal has taken steps to engage with these trends.

- Crypto Integration Recognizing the growing adoption of cryptocurrencies, PayPal launched crypto buying and selling services in 2020. This move marked PayPal’s entry into the burgeoning crypto space, allowing users to trade and hold major cryptocurrencies like Bitcoin, Ethereum, and Litecoin directly through the PayPal app.

- Stat: By 2022, over 26 million merchants accepted PayPal for cryptocurrency transactions, reflecting the company’s efforts to blend traditional finance with emerging technologies.

- DeFi and Blockchain Developments To stay ahead of potential disruption from decentralized financial systems, PayPal has been actively exploring blockchain technology and partnerships with crypto platforms. This ensures that PayPal can adapt to a future where decentralized systems could become more mainstream.

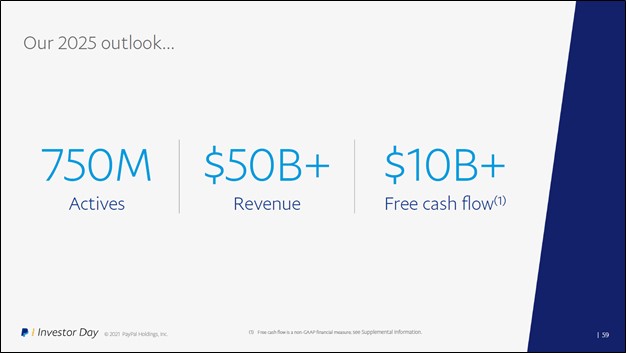

Future Outlook

As the fintech landscape continues to evolve, PayPal faces increased competition from both emerging technologies and well-established firms. However, with its global reach, strong brand recognition, and innovative approach, PayPal is well-positioned to continue winning the digital payment wars. Its multi-sided platform strategy, focus on security, and ability to integrate cutting-edge services like BNPL and crypto into its portfolio will be key to staying ahead in an increasingly crowded space.

- Stat: Analysts expect the global digital payments market to grow at a 13.7% compound annual growth rate (CAGR) between 2022 and 2030, potentially expanding PayPal’s total addressable market significantly.

- Stat: PayPal projects total payment volume (TPV) to exceed $2 trillion by 2025, supported by new product launches, geographic expansion, and a growing merchant network.

Key Strategies That Led to PayPal’s Success & Takeaways

PayPal’s rise from a small fintech startup to a global digital payments giant was not an overnight success. It involved a series of well-calculated moves, each strategically designed to dominate a rapidly changing landscape. The key strategies behind PayPal’s success provide valuable lessons for new entrepreneurs looking to build and scale their ventures, particularly in highly competitive or fast-evolving industries.

1. Focus on Solving a Real Pain Point

PayPal’s initial success was rooted in solving a specific pain point that had been largely overlooked: secure and easy peer-to-peer payments on the internet. In the late 1990s, e-commerce was growing rapidly, but transferring money between individuals online was slow, inconvenient, and risky. PayPal’s digital wallet allowed users to send and receive money electronically, eliminating the need for traditional payment methods like checks or money orders.

- Advice for Entrepreneurs: Focus on solving a real, well-defined problem in your industry, especially one that competitors may not have fully addressed. Being a solution provider to a pressing issue will set your business apart and give it immediate relevance in the market.

- Niche-specific tip: Narrow your target audience when launching—find an underserved segment, like PayPal did with eBay sellers, and optimize your product for their specific needs.

2. Viral Growth Through Referral Programs

One of the most impactful strategies PayPal deployed was its viral referral program. In its early days, PayPal offered users $10 for signing up and $10 for referring others. This resulted in explosive user growth at a time when customer acquisition through traditional advertising would have been cost-prohibitive.

- Stat: The referral program cost PayPal $60 million but resulted in over 7 million new users by the end of 2000.

- Advice for Entrepreneurs: Create a referral system or incentivized customer acquisition strategy that encourages word-of-mouth growth. This can be particularly effective for startups with limited marketing budgets.

- Niche-specific tip: If you’re operating in a competitive space like fintech or SaaS, offer tangible rewards (e.g., discounts, credits, or money) to attract early adopters and encourage them to evangelize your product.

3. Pivot and Adapt When Necessary

PayPal’s founders initially started Confinity to develop encryption software for Palm Pilots. However, when they saw the opportunity in digital payments, they quickly pivoted to focus on peer-to-peer payments. This willingness to change course and adapt to market demand was a critical factor in PayPal’s eventual success.

- Advice for Entrepreneurs: Be open to pivoting based on market feedback. Sometimes, the original idea might not be the most lucrative, but staying agile allows you to seize emerging opportunities.

- Niche-specific tip: In tech-heavy industries, continuously monitor user feedback and usage data to identify new trends or shifts in demand. Being flexible early can save time and resources down the road.

4. Strategic Partnerships and Integration

PayPal’s growth was significantly accelerated by its integration with eBay, which became one of its largest platforms. While eBay initially tried to compete with PayPal through its own payment service, PayPal’s seamless user experience and rapid adoption by eBay sellers helped it become the preferred payment option.

- Stat: By 2001, 70% of eBay auctions used PayPal, and by the time of PayPal’s IPO in 2002, it processed over 15 million transactions on eBay alone.

- Advice for Entrepreneurs: Identify strategic partnerships that can give you access to a larger customer base. Partnering with a well-established platform or company can provide immediate visibility and credibility.

- Niche-specific tip: For startups in B2B or tech, explore integrations with complementary platforms early on. If you’re building a tool, ensure that it plugs seamlessly into existing ecosystems like Shopify, Salesforce, or Amazon.

5. Obsess Over Security and Trust

One of PayPal’s greatest differentiators was its focus on security. In the early days of online payments, fraud and security breaches were significant concerns for both businesses and consumers. PayPal invested heavily in building robust anti-fraud systems, including machine learning models to detect suspicious activities and mitigate chargebacks.

- Stat: By 2002, PayPal had reduced its fraud rate to 0.39% of total payment volume, down from 1.8% in 2001.

- Advice for Entrepreneurs: In sectors like fintech, healthtech, or any field dealing with sensitive data, security must be a top priority. Developing trust with your customers by ensuring their information is safe can be a major competitive advantage.

- Niche-specific tip: Implement security best practices early—like two-factor authentication, encryption, and secure payment gateways—to build customer confidence from day one.

6. Expand Internationally at the Right Time

PayPal didn’t rush into international markets until it had built a stronghold in the US, primarily through its dominance on eBay. After its IPO, PayPal began expanding into markets like the UK, Germany, and Canada, which helped it grow even faster.

- Stat: By 2002, 25% of PayPal’s payment volume was from international markets.

- Advice for Entrepreneurs: Scale regionally before going global. Focus on perfecting your product, operational processes, and customer support in one or two markets before attempting an international expansion.

- Niche-specific tip: When expanding into new markets, localize your offering to meet cultural and regulatory requirements. PayPal succeeded internationally by adapting its platform to local payment preferences and legal standards.

7. Leverage Data for Decision-Making

PayPal’s success was largely data-driven. Its decision to pivot to payments, its fraud detection system, and its expansion strategies were all informed by data. PayPal closely monitored user behavior, transaction patterns, and market trends, which enabled it to make smarter, faster decisions.

- Advice for Entrepreneurs: Make data a central component of your decision-making process. Track key performance metrics (KPIs) from the start and use data to guide pivots, expansions, and marketing strategies.

- Niche-specific tip: Set up a solid analytics infrastructure (e.g., Google Analytics, Mixpanel, or Tableau) to monitor user behavior in real time. In fintech, for instance, analyzing transaction data can help refine pricing models or identify risk areas.

8. Consistent Innovation and Expansion

PayPal’s continuous investment in new services—like Venmo, Xoom, and its crypto offerings—helped it maintain relevance in an evolving market. Instead of resting on its laurels after becoming a dominant payment platform, PayPal continued to innovate by adding services like Buy Now, Pay Later (BNPL) and expanding into digital wallets and cryptocurrency.

- Stat: In 2022, PayPal processed over $1.36 trillion in payments, driven by a combination of new products and expanding market share.

- Advice for Entrepreneurs: Never stop innovating. Even when you’ve gained market share, constantly look for new ways to serve your customers or offer adjacent services. Stagnation can lead to obsolescence, especially in tech-driven industries.

- Niche-specific tip: Pay attention to emerging trends in your niche—whether it’s AI, blockchain, or new consumer behavior—and quickly test how you can incorporate them into your business model.

Leave a Reply